In the second of our blogs discussing EVDirect’s mission to assist pensions and workplace benefits providers to encourage and support employees’ financial wellness, we look at how best to keep people engaged throughout the user journey, attainable through an integrated approach.

It’s one thing to educate employees about how they now have the opportunity to take more control of their financial future, using handy tools supplied by workplace benefits schemes. That in itself is a marvel of the latest technology. However, it’s another thing entirely to make the journey to financial wellness in the workplace as simple, painless and achievable as possible for those keen to take control.

Of course, it’s vital to enthuse people to take action in the first place for their benefit, but it is equally if not more important to keep them continuously engaged through the journey – going beyond taking one-off actions. Avoiding the disengagement cul-de-sacs is the goal of integrating financial guidance tools with the benefits portal.

Providers of workplace financial products and solutions have been enhancing employees' benefits packages lately by adding financial wellness elements designed to help people take greater control of their personal finances and ultimately improve their financial future.

EVDirect’s guidance-focused lifestyle and retirement planning tools play a key role here, purposefully developed to inspire users to discover what they can do to improve their financial position. This supports those who are unable to access professional financial advice. Instead, they can be nudged and guided to understand better the state of their current finances and what lifestyle adjustments and monetary redirections they can enact to aim for a more secure future.

Helping people understand what they really do will engage them

By way of example, employees can use the tools to see what a modest voluntary increase in their pension contributions would bring them in terms of projected boosted monthly income when they retire – all with a few taps of the keyboard. They could also check whether their income protection plan and life cover are still sufficient for their current circumstances regarding family size, mortgage arrangements, caring responsibilities, etc. Employees being guided to tackle these and other areas of need will engender a greater sense of well-being concerning their financial future.

Educating people in the workplace about what’s now possible should get them past the starting gate, but what can be done to facilitate their journey to attain the full benefit of the new tools at their fingertips?

An example of this is the use of “what-if” scenarios. Read our blog; What-if scenarios illuminate the journey to better financial wellness in the workplace to find out more.

Building an integrated user journey consolidates user engagement

EVDirect’s guided planning tools – designed to engage with ease of use immediately – are most effective with employees when the tech is integrated into the provider’s benefits portal. Why? Because it’s a win-win for both user and provider:

- Fewer data points need to be keyed in by the user, which they often don’t know or can’t recall, and this can put them off going further

- Users can only spare a limited amount of time for this activity, so not wasting time looking for data to the input means they can see the journey through in the time available

- More accurate financial forecasts can be generated – consistently accurate, too – as the provider will hold the latest valuations and other up-to-date information

All in all, a more seamless experience for the user keeps them engaged throughout, and they are likely to spread the word to colleagues about the upsides of their experience (potentially leading to an increase in AUM for the provider).

Integrating a benefits portal with educational tools delivers consistency and financial wellness

The ultimate aim of giving employees the ability to gain greater control of their financial future is to enhance their comfort and peace of mind that they’re not (or no longer) in the dark about their financial prospects. This aim is achievable as long as they don’t drop out of the journey through confusion, complication or procrastination. A provider’s benefits portal integrated with EVDirect’s holistic, people-friendly, and easy-to-use guidance tools create an environment of engagement, consistency and support – very likely to inspire take-up and keep the user engaged in their journey towards financial wellness.

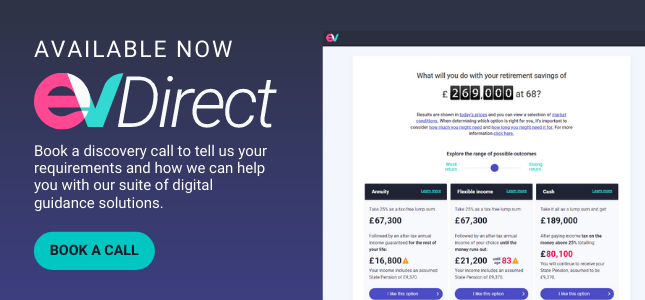

So what next?

At EV, we can support you on your journey to delivering valuable financial planning tools for your employees. We can supply the calculation engine, front end components or the whole journey. In addition, we can also offer the added flexibility of customised features and designs to our off-the-shelf tools to meet your needs.

Finding out more is easy – visit our website and book a discovery call.

%20(1)%20(1).png)