In this blog, we explore three ways of building consistent, easy to follow journeys that will help to improve the financial outcomes of your customers.

With consumer trust in the financial markets damaged and low levels of financial literacy, it’s vitally important that the provision of digital tooling supports your customers in making better decisions. A key part of this is delivering consistent customer journeys.

1. Remove any confusing jargon

Consistent customer journeys can cover a number of different areas. This ranges from the consistency in terminology and visuals to the underlying modelling.

A recent survey of 2,000 UK adults by investment app Freetrade found that nearly half lacked basic financial literacy and couldn’t answer simple questions about personal finance. [1] So keeping the financial jargon to a minimum is essential; don’t overcomplicate things by bouncing from yield to return to APR. Keep it simple, and ensure that your members aren’t having to Google every third word.

2. Provide an engaging customer experience

Having a consistent user experience is also a key element. Moving your customers from a snazzy new website with interactive graphics into a planning tool that could be generated in Excel ‘97 is a quick and easy way to bring an end to their session. Customers want to be visually engaged throughout the experience - and you don’t want to be losing them because you’ve neglected the look of the tool that is perhaps the most important part of their decision-making process.

This experience can also be improved by integrating the various platforms to ensure that any information is only required to be entered once. As a result, the customer feels as if they are only using a single site.

3. Boost customer confidence

Finally, and perhaps the most important consistency consideration is the forecasting model. Telling your customer that their ISA could be worth £15,000 in one tool but then £12,000 in another is only going to damage their confidence further. So instead, the model (yes, only one) should make appropriate assumptions and consistently forecast their finances across all tools.

This is particularly relevant where your customers can access financial support through a number of channels such as online guidance tools and IFA planning sessions. There is already some distrust from consumers towards advisers, and a change in figures will only compound that.

Conclusion

Improving the level of financial education remains a priority for governing bodies across the globe. Consumers having a good level of financial education and rebuilding their faith in the financial markets is essential for the overall stability of the financial system.

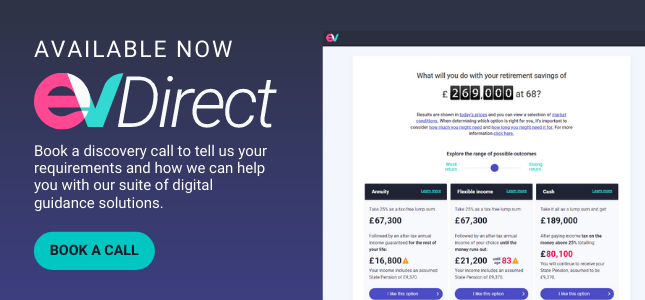

At EV, we offer a full range of financial forecasting tools to serve customers directly, via financial advisers, and even provide automated advice for customers who want a lower-cost option. These tools are constantly evolving to ensure they remain up to date with the latest technology and trends and are designed with customer engagement at the forefront.

Our Propositions team controls our wording and reviews from a high level to ensure jargon is minimised and there is minimal variance in terms. These tools are all underpinned by the same asset model, ensuring that your customers won’t see different results depending upon where they look.

Providing consistent customer journeys will only support the building of financial education and improve your customer’s outcomes.

References:

[1] https://freetrade.io/news/uk-financial-literacy-test