6 mistakes to avoid when building digital financial planning tools

This blog looks at 6 mistakes you should avoid when building financial planning tools that are aiming to maximise the support offered to consumers when making informed decisions around investments, retirement, and pensions.

Introduction

Providers are beginning to focus on supporting consumers to make informed decisions through the digital transformation of their solutions. With many providers building their own solutions, below we seek to offer helpful advice so you can avoid expensive mistakes and give you an insight into EV’s product philosophy.

1. Assume Nothing

The financial services industry has a reputation for not communicating effectively on key principles and therefore alienating large proportions of the consumer market. In reality, it should be doing the opposite and conveying those principles in an easy to understand way. Research has shown that the average numeracy age of a UK adult is equivalent to an 11-year-old and 1 in 7 of adults in England have literacy skills expected of a nine to 11-year-old.

Without striping the complex financial principles back to basics, the average end consumer will become frustrated and give up or make the wrong decision out of frustration. A good rule we use in our EVDirect suite is when we have to use jargon we make sure it has an easy to digest explanation, even things we take for granted as common knowledge like annuity, drawdown, defined contribution. It might sound obvious, but these explanations are often overlooked in favour of more functionality or features.

There are some simple changes you can make to improve your consumers understanding, including;

- Use different types of media: text, images, gifs, videos

- Highlight keywords or definitions in bold

- Use clear subheadings or bullet points

- Write in short sentences & paragraphs

- Don’t present all the information or options at once

2. It's all about the journey

How often have you been to a poorly designed or cluttered website and immediately left it? Now imagine you are trying to understand your financial situation and are met with the same confusing and poorly presented information. There would be only one outcome, back to watching Tiger King or Squid Games. It is likely the consumer is already apprehensive about learning or looking at their financial position. We must support them in this process and not make the experience any more intimidating.

We need to help them understand the key principles and make sensible financial decisions. Most people will initially want to know what they get from the service. An introduction is a good place to start. We could even add a video tour of the service or introduce a gamification aspect.

Once they understand what they will get out of the service, they will likely feel less intimidated and more enthusiastic about learning what they currently have. This could be the current value of their pension or their current contribution level. Providing them with their current situation allows them to work through what they already know, building confidence at the same time.

Now they are at the point where the tools add value to their decisions. The first question we should ask is what they need or want whilst also appreciating that they most likely don’t know what they will need in the distant future. People have a tendency to feel they need the same as their neighbours, so providing industry recognised data such as the PLSA Retirement Living Standards would comfort the consumer and inform their choice of goal. We then need to help them reach that goal, more on that in points 4 & 5.

3. Design over science

In an industry built on spreadsheets and complex modelling techniques, we can sometimes lose the balance between science and value-added. For example, does the consumer care if we model an investment return of 2.5% or 3% or assume inflation is 3.5% or 4%? The most likely answer is no. If it isn’t, then they will likely have their own modelling spreadsheet. But these assumptions often take up the majority of our resources when we should focus on other aspects such as the user interface or user experience. This will ultimately make the consumer engage and return to the tool.

In the modern-day era where gaming has redefined what an interface should look like, the financial world has stood still. Having simple input boxes and dropdowns doesn’t engage anymore, especially when interacting with a 3D graphic of Spiderman or Hulk on Fortnite or even swiping jelly beans on Candy Crush. Now we aren’t saying add Hulk to your retirement planner, but it is time to move to a more modern and engaging interface.

In a society where people won’t even wait 10 seconds for an advert to finish, they are unlikely to read pages of text on how investment returns vary per asset class. It’s time to add a video or a gif. Keeping the content short and snappy will help the user to understand and want to continue reading, adding quizzes or checkpoints can help them re-affirm their knowledge. It’s time to put design before science.

4. Be inclusive and embrace the uniqueness of the individual

In a modern world where all aspects of society embrace inclusivity and uniqueness, it is important to have the same mindset when designing financial planning tools. Consider how the financial landscape has changed over the last 50 years from high inflation and interest rates to the reverse. The transition from defined benefit schemes to defined contribution schemes. The pension freedoms launched in 2015. How can we expect one tool to serve every individual?

We have to consider each generation and demographic separately. From one household income of Baby Boomers to the high property wealth of Generation X to the YOLO (you only live once) mindset of Generation Z. In those generations, there will be varying wealth and disposable income.

Therefore when designing a retirement planning tool, it is worth considering how each generation/demographic could finance their retirement.

| Generation or demographic | Method of financial retirement |

| Baby boomers | Defined benefits or annuities |

| Generation X | Equity release or property downsizing |

| Generation Z | Encouraged to contribute through schemes like auto-enrolment |

| High Income/wealth | Liquidate their assets or large pension pots |

| Low Income/wealth | Could/would they sacrifice a desirable item now for an essential item later |

5. Encourage personalisation

Now we have identified that everyone is unique, how do we personalise the tool we are developing? It could be as simple as using their name in the tool to advanced behavioural science techniques like framing or anchoring. By adding any sort of personalisation, the consumer is instantly more engaged and reassured by the tool and more likely to return.

Consumers now have many more options to choose from in the financial space, ranging from the provider to the product to the investment strategy. These sorts of decisions can be supported by digital advice or automated advice, allowing the consumer to feel reassured that they are making the correct decision without the need for face to face advice.

We also need to consider that everyone will have different needs from their financial situation. Some may not be able to afford to save £1 today with the hope of £2 tomorrow. Everyone will require different incomes at different times, from university fees, wedding costs to retirement and funeral costs. That income will also come from various sources: salary, rental income, investments, pensions, inheritances or property. Everyone must have a tool to use for their situation.

6. Plan, Plan, and Plan again

Now you know what you need to build, it is time to figure out how to build it.

The first step is to create captivating designs that avoid the mistakes mentioned above. Then complete user testing of those designs to see how awesome they are, but make sure you are honest with yourself and iterate based on the users’ feedback.

Once the designs are finalised, a delivery plan is needed, and a decision needs to be made on whether you take an agile or waterfall approach (or something in between). Whichever approach is chosen, make sure the whole team is aware and buys into the decision.

The work then needs to be estimated and, vitally, contingency added - things never go to plan! It is important to remember that things can change and to adapt to this and replan regularly. Even during the build phase, feedback should be sought from consumers, releasing bits of functionality at regular intervals could help with this.

Conclusion

Building a financial planning tool is easy but building an excellent financial planning tool is a challenge. Therefore, it is important to avoid the 6 mistakes when targeting an engaging and educational financial planning tool.- Assume nothing

- It’s all about the journey

- Design over science

- Be inclusive and embrace the uniqueness of the individual

- Encourage personalisation

- Plan, plan and plan again

So what next?

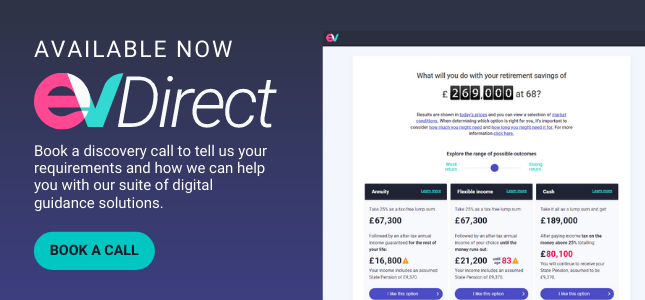

At EV, we can support you on your journey to delivering a powerful financial planning solution. We can supply the calculation engine, front end components or the whole journey.

In addition, we can also offer the added flexibility of customised features and designs to our off-the-shelf tools to meet your needs.

If you would like to get in touch or speak to a team member, please email us; contact@ev.uk