When Pension Freedoms were introduced back in 2015, they expanded the landscape of decision making for consumers - and not only for those retiring but also those planning for their retirement.

Deloitte’s UK Retirement Innovation paper reported that “loss-aversion and adverse perceptions of the pensions sector generally result in low consumer engagement and increase the risk of sub-optimal retirement income decisions”.

Combine this challenge with the impact of the COVID-19 pandemic upon consumers’ financial security, and we have a market where the need for engagement and education is high.

The digital solutions that support consumers in making these important financial decisions need to continue evolving and innovating. Consumer demands and technology expectations are rapidly changing, with the financial industry a long way behind the trend.

Our approach

To ensure that our solutions do continue to serve consumers, we’ve spent the past 6 months working closely with our clients and their customers to identify a number of key improvements.

We’ve gone through several "test and learn cycles" while building out an Innovation Community to ensure we are keeping our ears to the ground and reacting to any new industry trends. Test and learn enables us to measure how effective our improvements are, based on feedback gained from incremental releases.

The test and learn has focussed on specific elements of the user journey to understand where consumers require the most support and education. Our Innovation Community is built-up of clients and industry experts, all willing to share their ideas on our solutions and drive innovative thinking.

The results

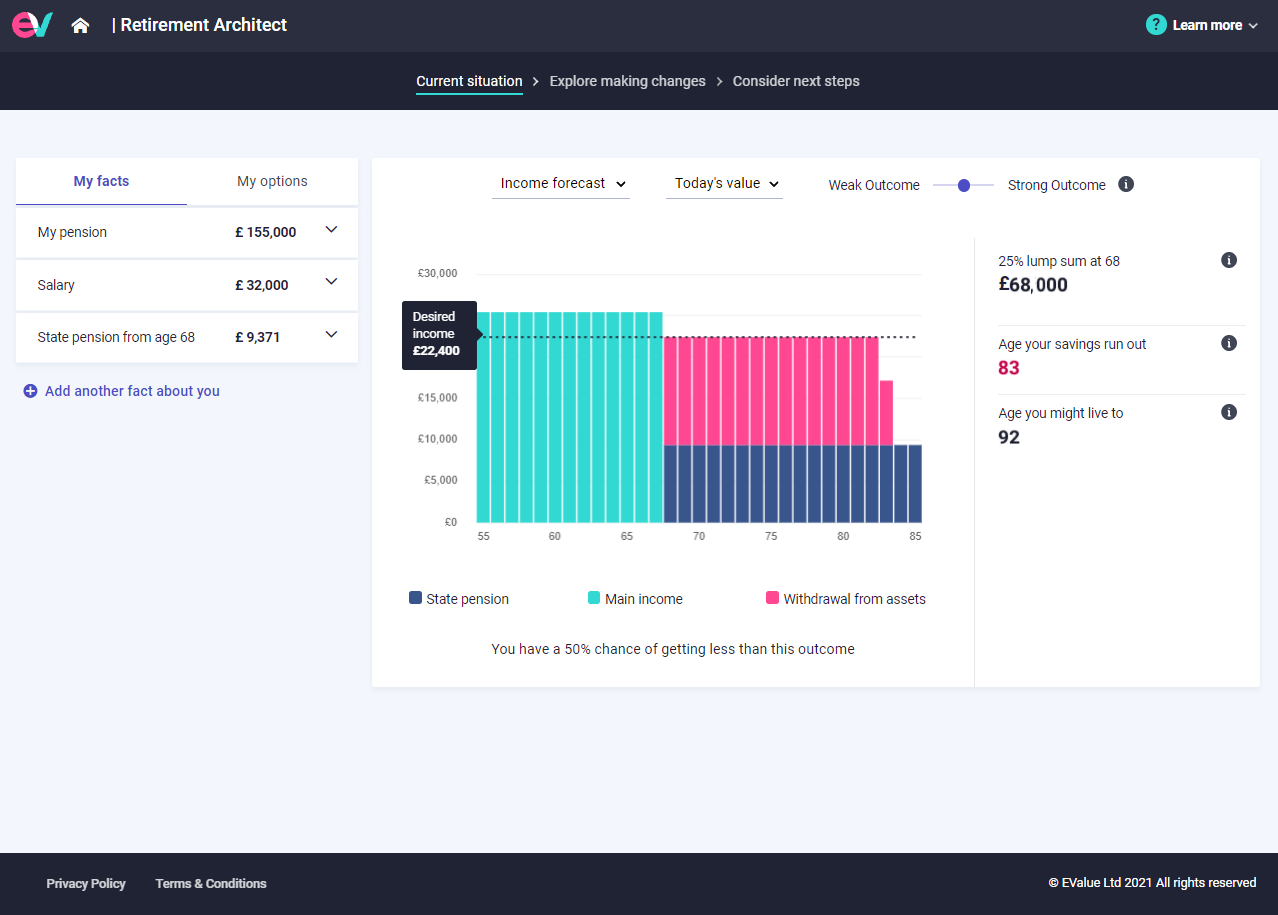

We’ve updated our user interface to a standard that consumers are more familiar with, and therefore more comfortable. In addition, we’ve expanded upon our educational content and tone to ensure they are delivered in a way that consumers can relate to - including the addition of video walkthroughs, assisting consumers in gaining the most value from their session.

We’ve also added many features that support clients building a better future retirement plan, including working part-time in retirement, equity release, and a focus upon the benefits of their planned changes. In addition, at any point in the journey, users can submit direct feedback upon the tool.

EVDirect Retirement Architect

So what next?