Stochastic vs Deterministic Models: Understand the Pros and Cons

When it comes to providing your customers with realistic forecasting, there are only two models to choose from. The first is a deterministic model, and the second, a stochastic model.

There are several key differences between the two types of modelling techniques that are both used widely across the world of financial planning.

Now more than ever, with increased market volatility and other economic uncertainties, the limitations of deterministic and some stochastic models need to be fully understood to avoid unintentionally harming your customer’s future retirement plans and lifestyle.

In this article, we outline the differences between the two approaches, and discuss the pros and cons of each type of model. This way you can better understand how these differences can impact your ability to provide realistic forecasting to your customers.

What are Stochastic and Deterministic Models?

We’ll start with some simple definitions to get us started;

Deterministic

Deterministic (from determinism, which means lack of free will) is the opposite of random.

A Deterministic Model allows you to calculate a future event exactly, without the involvement of randomness. If something is deterministic, you have all of the data necessary to predict (determine) the outcome with certainty.

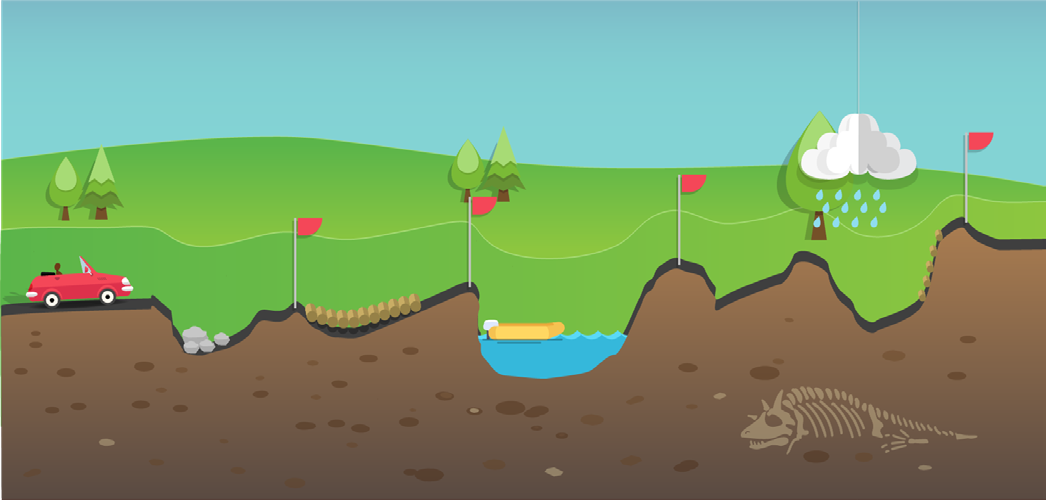

A simple example of a deterministic model approach

Stochastic

Having a random probability distribution or pattern that may be analysed statistically but may not be predicted precisely.

A Stochastic Model has the capacity to handle uncertainties in the inputs applied. Stochastic models possess some inherent randomness - the same set of parameter values and initial conditions will lead to an ensemble of different outputs.

A simple example of a stochastic model approach

The Pros and Cons of Stochastic and Deterministic Models

Deterministic Models - the Pros and Cons

Most financial planners will be accustomed to using some form of cash flow modelling tool powered by a deterministic model to project future investment returns. Typically, this is due to their simplicity.

Often, a single estimate for an investment return, such as 2%, 5% or 8%, is used to predict the future value of a fund or portfolio. This is the basis of deterministic forecasts, which produce a specific result for a specific input - every single time.

Deterministic models are typically used by product providers to illustrate statutory future projections of long-term investments (such as pensions). If the same projection rates are used, these forecasts can then be used to compare different providers, particularly around charges.

However, deterministic models do not make any allowance for the fact that markets are complex, irregular and ever-changing. As such, any model that is based on long-term average returns can be easily upset by the unexpected implications of sequencing risk, which can have a huge impact on a retiree’s income and lifestyle in retirement.

Pros

- Deterministic models have the benefit of simplicity. They rely on single assumptions about long-term average returns and inflation.

- Deterministic is easier to understand and hence may be more appropriate for some customers.

Cons

- Cash flow modelling tools that use deterministic or over-simplistic stochastic projections are fundamentally flawed when making financial planning decisions because they are unable to consider ongoing variables that will affect the plan over time.

- Deterministic tools tend to overestimate the level of sustainable income (on a like for like basis) because they are unable to take into account market volatility, which causes ‘pound cost ravaging' and sequencing risk, both of which have a significant negative effect on sustainable income.

- The choice of future increase assumption is critical and puts the responsibility of the final outcome on the provider of the tool

All of which renders deterministic models inadequate and potentially misleading.

Stochastic Models - the Pros and Cons

Stochastic Models, use lots of historical data to illustrate the likelihood of an event occurring, such as your client running out of money. These types of financial planning tools are therefore considered more sophisticated compared with their deterministic counterparts. A stochastic model will not produce one determined outcome, but a range of possible outcomes, this is particularly useful when helping a customer plan for their future.

Pros

- Stochastic models can reflect real-world economic scenarios that provide a range of possible outcomes your customer may experience and the relative likelihood of each.

- By running thousands of calculations, using many different estimates of future economic conditions, stochastic models predict a range of possible future investment results showing the potential upside and downsides of each.

- A stochastic model also has the ability to avoid the significant shortfalls inherent in deterministic models, which gives it the edge.

Cons

- Managing drawdown effectively and choosing suitable investment strategies requires the ability to model investment risk and return realistically. The problem is that nearly all strategies and solutions are currently designed using an assumed fixed rate of investment return throughout retirement. This is obviously unrealistic and ignores the important effect that the sequence of returns and volatility has on drawdown outcomes.

- The problem of ignoring specific risk factors not only applies with deterministic modellers, but also with a commonly used type of simple stochastic model - mean, variance, co-variance (MVC) models. For instance, MVC models provide time-independent forecasts, which means that they ignore the fact that specific investment risks change over time depending on the combination of assets held within the customer’s portfolio.

So which is the best modelling solution?

EV believes that the limitations of deterministic and MVC stochastic models are extremely concerning and could lead to unintentional negative consequences for customers. What is needed, is a stochastic model which has the capability to forecast thousands of potential future economic scenarios, that develops year by year based on the data, and allows for the possibility of high volatility and a sequence of bad returns in the early years - both of which are major threats to the success of a retiree's drawdown plan.

Allowing for these real-world effects when modelling future outcomes, particularly in drawdown, is essential and only Economic scenario generator (ESG) stochastic models (which reproduce real-life characteristics of assets), have the ability to do this.

Although an ESG model is built by looking at historical data to determine the characteristics of different investment classes and their correlations, using historic performance does not provide enough independent scenarios. It is highly dependent on the periods selected, and, as the Financial Conduct Authority (FCA) keeps reminding us, past performance is not a reliable indicator of future results.

Financial planners, advisers, and product providers alike need access to reliable modelling tools so that they can develop reliable plans for their customers. Not allowing for sequencing risk and realistic levels of investment volatility will systematically result in over-estimating the retirement income that can be supported by a drawdown plan. As we mentioned earlier, this would cause catastrophic harm to your customer’s future retirement plans and lifestyle.

So, in our mind, the best solution is one based on an ESG model that takes into consideration thousands of forward-looking forecasts from the current economic situation. We believe this is a uniquely powerful modelling solution, that can help to protect your customer’s future retirement, where other models simply can’t.

So, what next? Get our Stochastic Models Ebook

We provide an outline of the various types of forecasting models here. A complete, real-time picture of all the potential outcomes makes all the difference to realistic outcome planning. And that’s the difference between a deterministic model and a stochastic model.

Find out more about stochastic forecasting and why we believe it’s the most credible model by reading our eBook, Modelling Future Outcomes. Why Stochastic is the Credible Choice?