What-if scenarios illuminate the journey to better financial wellness in the workplace

.png)

Providing employees with a benefits package that encompasses well-being is so commonplace that the absence of financial well-being measures would be a disadvantage in recruiting and retaining the best people. In this blog, we explore how “what-if” scenarios can help communicate different financial outcomes to provide better financial wellness in the workplace.

Health-promoting benefits such as gym memberships, counselling services and parental leave are all good, but empowering employees to achieve future financial wellness has become centre stage post-pandemic, with people’s renewed wish to have control over their financial future as they progress in their careers and edge towards retirement. Facilitating this aspect of wellness is educating employees about what their financial security truly hinges on – but as importantly, they need easy-to-use tools to gain control over their finances.

It’s quite clear that the last couple of years has done more than disrupt and disturb normal life in the workplace. While the focus has been on the interruption of traditional working practices, there’s been a strong undercurrent of financial instability and anxiety that has prompted many to re-evaluate their finances and future. The jury is still out, but a certain era may be dissolving – the age of avoiding playing an active role in attaining a more secure financial future instead of leaving it mostly to luck and a vaguely acknowledged reliance on employer and government pension provisions.

So, it’s an opportune time for providers of workplace financial products and solutions to consider how best to facilitate those who now want greater control in securing their future financial position. A good starting point is engaging employees through a range of educational exercises that guide them about how they can take proper charge of investing for their future without accessing professional advice they simply can’t afford. That’s a very sensible first step.

Lifestyle and retirement planning in workplace members' hands

Learning what you can do with your own money as a more active consumer investor begs an immediate question: how to do it. This is where personal financial tools enter the equation.

Using technology to move money around is one thing – and is increasingly familiar to tech-savvy users thanks to ubiquitous mobile phone banking and various remote ordering and payment activities. However, with your future finances at stake, the tech itself can be dangerous if your money can be swallowed up instantly due to personal errors ranging from simple misjudgement of financial options to out-and-out scamming by fraudsters. Instead, what’s needed is well-crafted guidance taking consumer investors on a journey of discovery, intending to gain the insight to make good financial decisions continuously.

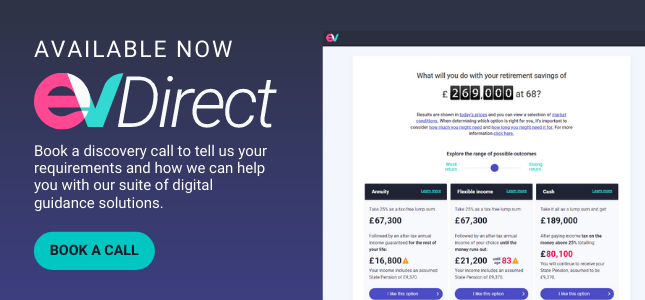

EVDirect has been heavily engaged in developing guidance-focused lifestyle and retirement planning tools for consumers. However, it was evident that people didn’t want to be deluged with oceans of ‘do this, don’t do that type information, or be presented with answers on a plate that are hardly tailored to them as individuals. So instead, a journey with multiple pathways has been carefully built by EV that takes consumers through a series of ‘what-if’ scenarios predicated on helping the workplace member to:

- fully understand where their hard-earned money is currently invested

- see how they can improve on their situation and aim for a better outcome in later life

- grasp what might happen if the markets don’t perform well

Learn more in our accompanying blog; 3 ways to improve financial outcomes through consistent customer journeys.

Seeing the benefits of making positive changes to personal finances

These what-if scenarios delve into many aspects, including such matters as what would ensue if you spent less today on discretionary items like takeaway coffee and multiple streaming services and what your retirement income could be if you tucked x, y and z amounts of money in your pension scheme from now on.

Using what-ifs helps identify the sensible changes people could make, promoting positive behaviours. But, equally, what-ifs can be used to educate about potential negative outcomes; forewarned is forearmed.

Better outcomes for the unadvised go beyond individuals

EVDirect’s tool suite is a far cry from some other planning software available in the market that merely focuses on the current situation. That can be helpful, but it’s just not enough.

Engaging educational videos and what-if scenarios complemented by in-tool prompts and nudges bring personal finances to life, putting EVDirect at the forefront in the widely pursued drive to inspire better financial outcomes for unadvised investors. And what benefits the individuals involved is good for families and society in general.

For the providers of workplace solutions, there are tangible benefits to giving their employees/members the means to boost their understanding of financial planning and their relationship with money and thereby make better investment decisions. More aware and engaged people are more likely to take up opportunities to invest more, and by word of mouth, encourage colleagues to make the same smart moves – with all roads potentially leading to increased AUM for providers.

So what next?

At EV, we can support you on your journey to delivering advantageous financial planning tools for your employees. We can supply the calculation engine, front-end components or the whole journey.