This blog explores how supplementing consumer financial recommendations with forecasts can help take employees' financial wellness to the next level.

Consumers' finances are a complex landscape, ranging from daily budgeting to ensuring an appropriate level of mortgage protection to saving for a rainy day or their retirement.

What is financial wellness?

Financial Wellness is defined as “effectively managing your economic life” and significantly impacts consumers’ sense of well-being.

Well-being is defined as "having financial security and financial freedom of choice, in the present and the future” (Consumer Financial Protection Bureau)

With the two concepts so intrinsically linked, it is imperative that consumers can access solutions that enable them to make informed decisions around their finances and improve their overall well-being.

How are employers supporting financial wellness?

In recent years, employers have taken a more active role in their employees’ well-being, with many now providing solutions to support their financial well-being. Moreover, these services have rapidly expanded over the past few years, given the expansion of the tools on the market.

Based on a digital fact-find, most of these solutions will make a string of generalised recommendations to contribute more to their pension.

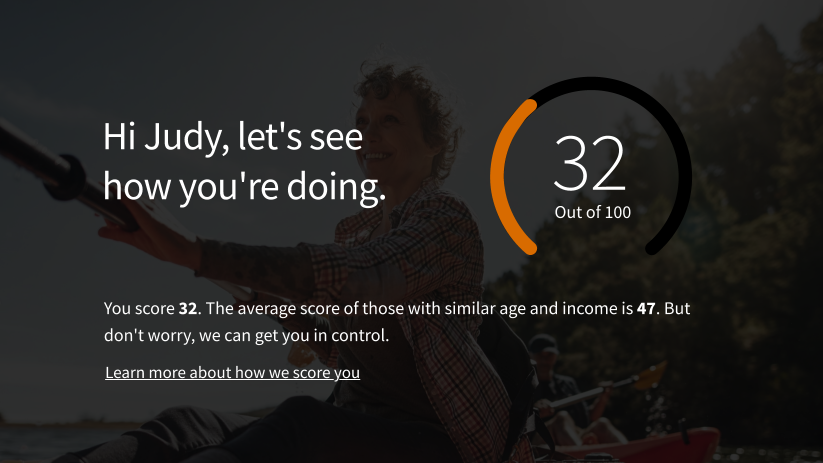

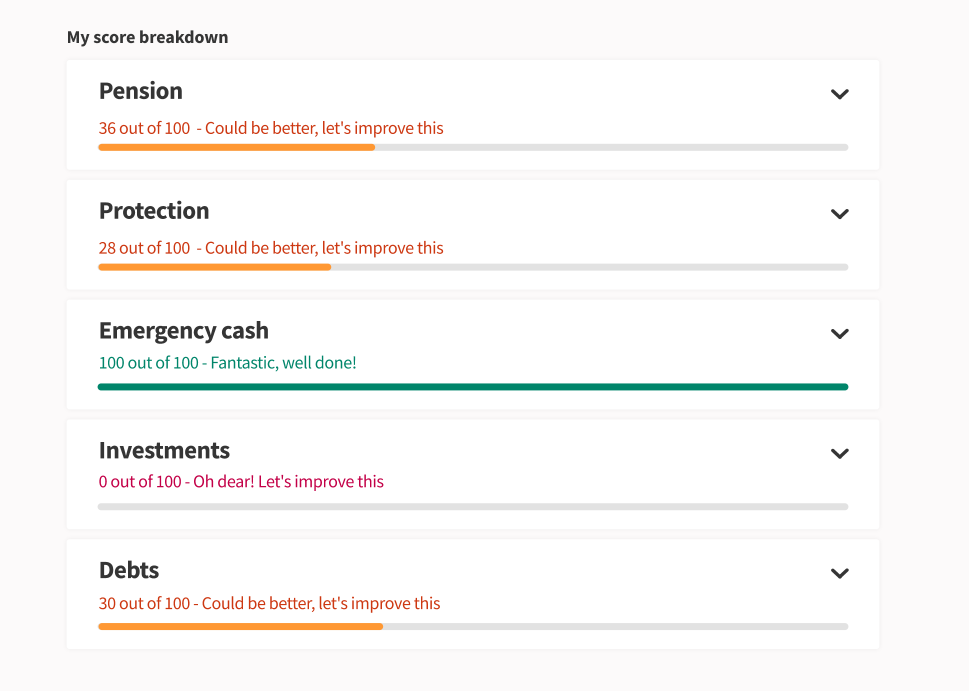

But what if we could go a step further and suggest a level of contribution relevant to their situation or provide a score based on their current situation versus the optimal scenario?

This way, employees can identify their priorities and take relevant actions.

The benefits of forecasting

Everyone’s situation is different, so managing their economic life will also be different. Even maintaining a basic emergency fund will vary from employee to employee.

Therefore, we can use forecasting and calculations to allow for this much better than making a generic recommendation. Providing the employee with better information will enable them to make more positive decisions.

Suggesting a specific change

Most aspects of the employee’s economic life will have a target. For example, they may be saving for a particular goal on their investments. Therefore, we can calculate the level of contributions required to reach that goal and suggest this as an action that the employee could take.

Calculation a wellness score

Again, given the employee’s economic life is likely measurable, we can see how their current situation matches their desires. Using the same example above, we could see how much they are contributing and compare that to the amount required to meet the goal. This score can give the employee an idea of how close they are to their desired situation, then identify their priorities.

It’s easy to see how this extra level of detail can rapidly improve the impact of the wellness solutions upon the employee.

So what next?

We have a full suite of powerful APIs that can support you in taking your Financial Wellness solutions to the next level. If you’d like to find out more about these APIs and understand how they can supplement your offerings, please email me to get in touch.