Providing financial planning tools in the workplace has rapidly progressed over the last few years from a simple box-ticking exercise for the employer to a genuine desire to provide engaging and educational tools that are advantageous as part of the benefits package. This is, in part, down to the widening definition of an employee’s wellbeing.

The Financial Wellbeing buzz

Wellbeing has always indirectly included an employee’s financial situation, but the term “Financial Wellbeing” has become a real buzzword in the market.

According to Aegon, “Financial wellbeing is how people feel about the control they have over their financial future - and their relationship with money. It's about focusing on the things that make their life enjoyable and meaningful both now and in retirement.”

A large part of this is how people understand their finances. Not understanding or mistrusting their pension, for example, is unlikely to build a positive relationship and could prevent them from making positive decisions to support their retirement.

This has led to an increased focus on financial tool engagement and educational content. But, as the title suggests, improving an employee’s financial education isn’t just about the words.

So what is financial education all about?

Supporting tooling that truly educates people will do this through all aspects of the content.

The collection of data should consider that not all employees will know where to look for their current level of pension contributions or their investment strategy. So people need to have their hands held, be gradually introduced to this information and pointed towards where it is readily available. We’ve also found it useful to direct them towards additional supporting services, such as Money Helper, which will help them find the required data and understand it.

The user journey itself can introduce aspects of the tool gradually. Rather than an information overload, the employee can start to understand the tool one part at a time and build their education.

Our new Quick Tool designed to encourage additional employee contributions puts this idea into practice. After collecting the user data, the employee receives a forecast of their pension at retirement before seeing an increased pot according to their additional savings. Following this, the pot is converted into a more relatable income - which brings me to my next point.

To better understand the forecasts you are seeing, the values you choose to present should be relatable. For example, a graduate might not understand whether a particular pension pot at retirement will be sufficient. On the other hand, an income is much more relatable, as they can understand what spending will support. The presentation of these forecasts is clear and doesn’t require a doctorate to understand.

Finally, the underlying assumptions of any forecasts should be appropriate. If we continue with the previous example, a forecasted income in 40-odd years needs to have inflationary measures applied so that the employee can see their expected spending in today’s values. Considering the latest CPI figures (4.9%), the roll-back used for 40-year forecasts is over 600%!

But don't forget about the words

Of course, the importance of the wording throughout the tooling should not be ignored. As our previous blog; 3 ways to improve financial outcomes through consistent customer journeys” reports, the use of jargon and mixing terms should be avoided wherever possible. The financial concepts you are introducing to people need to be simplified and delivered to the level of financial understanding your employees have.

So when you are selecting the best-suited tools for your employees or designing a journey yourself, make sure that you consider all areas of the educational content that will take your employees’ wellbeing to the next level.

So what next?

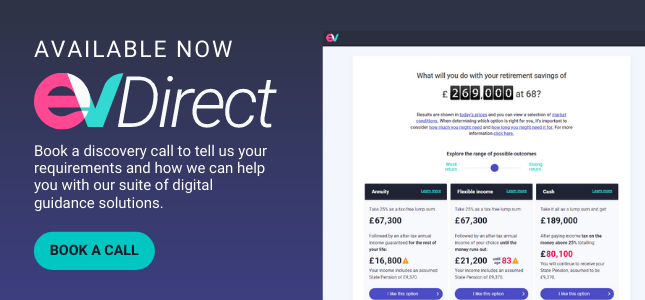

At EV, we can support you on your journey to delivering advantageous financial planning tools for your employees. We can supply the calculation engine, front end components or the whole journey.