Our latest blog discusses EVDirect’s drive to help pensions and workplace benefits providers inspire and support employees’ financial wellness. We examine the vital tech that underpins good decision making when people choose investments and pension provisions in search of the lifestyle they wish in future, including retirement.

Let’s take it as a given that workplace members have responded positively to educational initiatives illuminating their ability to take greater control of their financial future, using engaging guidance tools woven into their workplace benefits portal. Moreover, let’s assume they are now motivated – and remain interested and engaged – when embarking on and continuing their journey to tweak, realign and improve their financial prospects with the help of the tools. Thus far, all is good.

But, what is the key to ensuring the actions they decide to take are grounded in reason rather than wishful thinking? The answer lies in how the future is modelled in the tools.

When employees ‘play’ with guidance tools to see what they can do to improve their financial prospects, they are likely unaware of the modelling technology that runs under the bonnet. But this tech is the precursor of good decision making.

Modelling prospects more accurately cast aside any old models

EV applies proven modelling techniques to enable the EVDirect tools users to make informed and sensible decisions to enhance their financial future. Without dwelling too long on the science behind this, we utilise stochastic instead of deterministic modelling to project the future. Where a deterministic model generates investment illustrations based on nominal fixed growth rates to indicate what people’s investments might be worth in the future, sophisticated stochastic modelling provides forecasts that include a degree of randomness or uncertainty – to closely mirror the real behaviour of national economies and financial markets. Market performance is never guaranteed, and the stochastic model can communicate this clearly to the user.

With this modelling in play, the relationship between potential risk and possible reward can be better understood, bringing realism to decision making. Accounting for various market scenarios that can occur adds more real-life elements to the mix. People can easily see what can ensue in their investment journey, in line with the propensity for ups and downs to crop up in the medium and long-term.

Projecting the future of personal finances needs to be credible

This results in projections considering the probability of meeting the tool user’s desire for financial returns across many independent market scenarios. And so, people are empowered to make more informed decisions around their investments and pension arrangements. This tallies well with the FCA requirements for providers to give their end customers reliable information to base their decisions on personal financial matters.

With EVDirect’s planning tools creating credible projections of financial futures based on variable inputs, the issues that workplace members need to address now are highlighted. It could be as simple as voluntarily increasing their pension contributions or more multifaceted, such as reviewing their current discretionary expenditure, seeing what they could live without, and diverting such spending into long-term investments to live better later.

An example of this is within the “what-if” scenarios functionality. Please read our blog; What-if scenarios illuminate the journey to better financial wellness in the workplace, to find out more.

Increased financial wellness is attainable, starting in the here and now

For pensions and workplace benefits providers, EV’s proven modelling expertise that permeates the suite of tools is readily available to remove the stress and uncertainty involved in building in-house capabilities to match EV’s precision.

To corroborate this, EVDirect’s track record can be evidenced in the 152,000 tool sessions over the past year – each an opportunity to help the tool user make their hopes for their financial future more realisable via well-informed decision making.

Incorporating EVDirect in the unadvised employee arena is a powerful enabler when cultivating financial wellness in the workplace.

So what next?

At EV, we can support you on your journey to delivering valuable financial planning tools for your employees. We can supply the calculation engine, front end components or the whole journey within one integrated customer journey.

Please read our blog; Let’s get engaged on the road to financial wellness in the workplace, to find out more.

In addition, we can also offer the added flexibility of customised features and designs to our off-the-shelf tools to meet your needs.

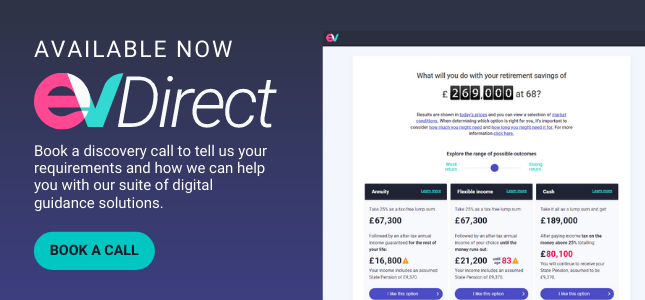

Finding out more is easy – visit our website and book a discovery call.

%20(1).png)