Why Sequencing Risk Should Matter to Your Drawdown Customers

Being able to bring sequencing risk to life for your customers in a way that aids genuine understanding when setting a drawdown plan is priceless.

Simply put, sequencing risk is the danger of your customer’s pension savings pot being exposed to the worst returns at the worst possible time. This risk will be at its highest in the final few years prior to retirement and as they begin to drawdown income from their pension fund - so timing is everything.

What this comes down to, is the pattern of portfolio returns delivered by the underlying investments due to their inherent unpredictability. Returns will vary from year to year and this volatility makes a big difference to the size of your customer’s pension pot. It will also determine how much they can realistically withdraw to pay for their desired lifestyle in retirement.

As your customer transitions from contributing to their pensions saving pot during their working life (accumulation) to drawing on it (decumulation) this is even more important.

At this stage in your customer’s financial life-cycle, they will have the greatest amount of money at stake, so a run of poor investment returns at the start of it will have a negative impact on the remaining pot that they have to draw upon.

Key things to know about sequencing risk

It’s not what you do - it’s the order that you do it.

The key to sequencing risk is the order – or sequence – in which your investment returns occur. During the accumulation phase, your customer probably didn’t worry too much about periods of market volatility, as they would have had many years ahead to smooth out any bumps in the road with their investment returns.

If a customer’s pension pot value drops 10% when they first start saving for their retirement, it’s easier for them to accept, as their pot is smaller, and there is plenty of time to increase the overall value. However, as they reach the point of retirement, the sequence of investment returns becomes critical. If a customer is only a few years away from retirement, the same negative 10% return will have a considerable impact on their retirement plans. If we consider 30+ years of pension contributions and investment returns have grown their pot to a much larger size, a 10% drop in the value of their pension will have a significant impact - and make your customer think twice about when they can afford to retire.

Timing is everything when managing sequencing risk

Financial markets switch through periods of bull and bear markets. And following a period of sustained market tailwinds, there tend to be headwinds on the horizon. The impact on a retiree starting to draw an income and entering the market at the ‘wrong’ time can leave them exposed to widely different outcomes.

For instance, a customer choosing to retire when prices have fallen and returns are low (or worse – negative), will need to sell more units of their fund to draw their desired level of retirement income. This will run down their portfolio much more rapidly than if returns were high.

When returns improve, and the market recovers, they have fewer units left over to take advantage of the rising market. This effect is compounded, meaning their prospects worsen come to the next market downturn. The opposite applies if retirement begins when returns are high.

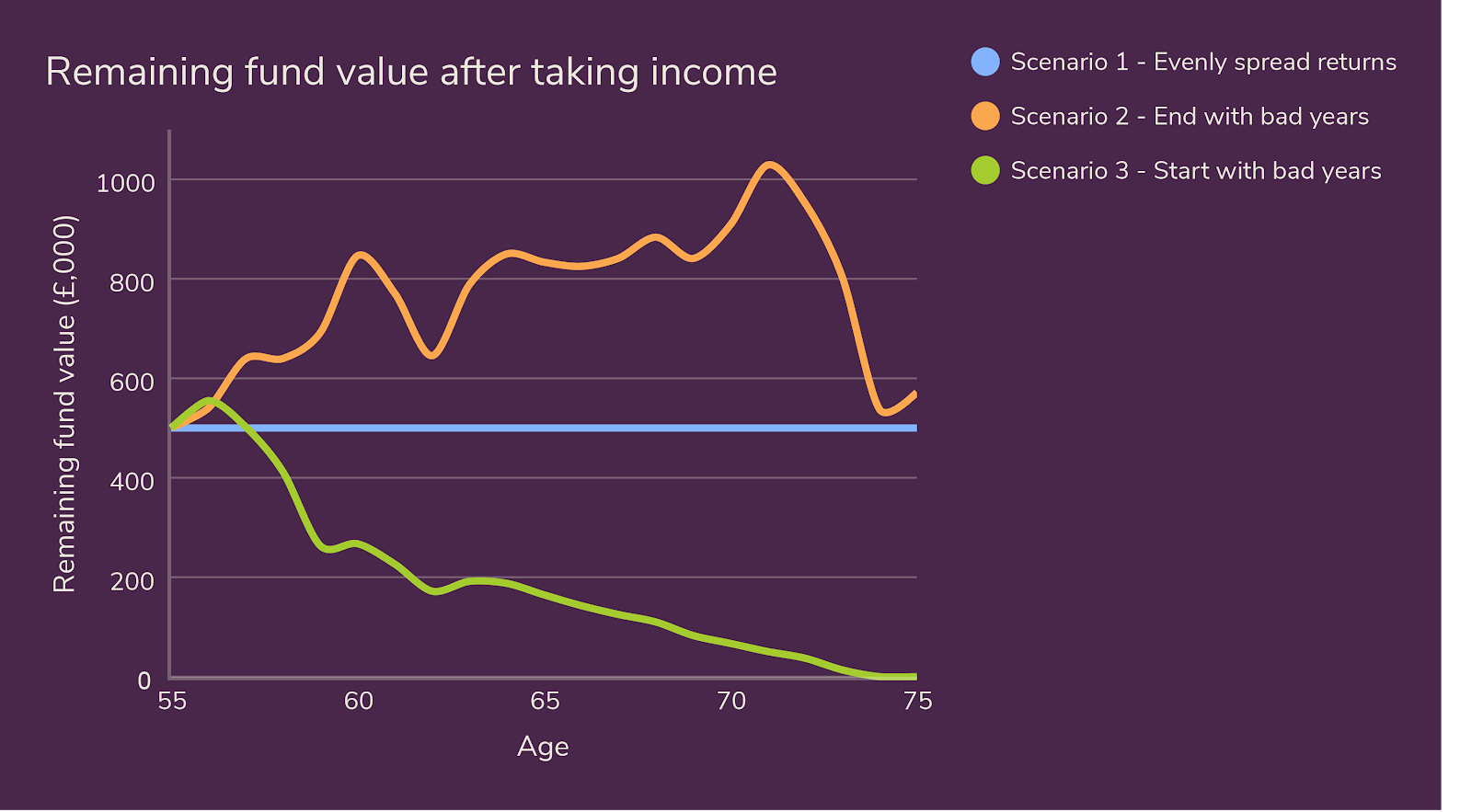

The below chart summarises sequencing risk by showing how drawing the same constant income in three scenarios, all with the same average returns, turns out very differently over time:

Sequencing risk can also make the difference between your customer being able to leave a legacy to those they leave behind and running out of money before death.

Helping your customers avoid sequencing risk

One solution would be to reduce the amount of income drawn, however, this would lead to a less comfortable lifestyle in retirement. Another could be for your customer to delay retirement - working longer to ride out the downturn and retire once market conditions are more favourable. But, delaying retirement may not be an option for everyone.

Retirees in this situation need support if investment markets shift downwards in the early years of retirement to avoid disappointment and the risk of being forced to adopt an increasingly frugal lifestyle in later years.

The trick to managing sequencing risk, in fact, any investment risk for that matter, is in providing simple online tools to help educate your customers. That way they can easily understand the different scenarios that might play out - especially in the latter stages of accumulation and early stages of decumulation - with reactive changes they might need to make to keep their retirement plans on track.

We discuss the various types of forecasting models that can help with this in our accompanying blog; Stochastic vs Deterministic Models: Understand the Pros and Cons. This way you can better understand how these differences can impact your ability to provide realistic forecasting, so your customers can make better-informed choices.

So what next?

The importance of giving due consideration to sequencing risk when setting a drawdown strategy cannot be overstated. To find out how stochastic forecasting can help provide more realistic projections, download our eBook; Modelling future outcomes: Why stochastic is the credible choice?