Our latest white paper; Drawdown: The Mirror Image of Accumulation proposes and evidences that the industry’s current tools and processes servicing drawdown are largely unfit for purpose, as they are re-purposed accumulation tools and techniques.

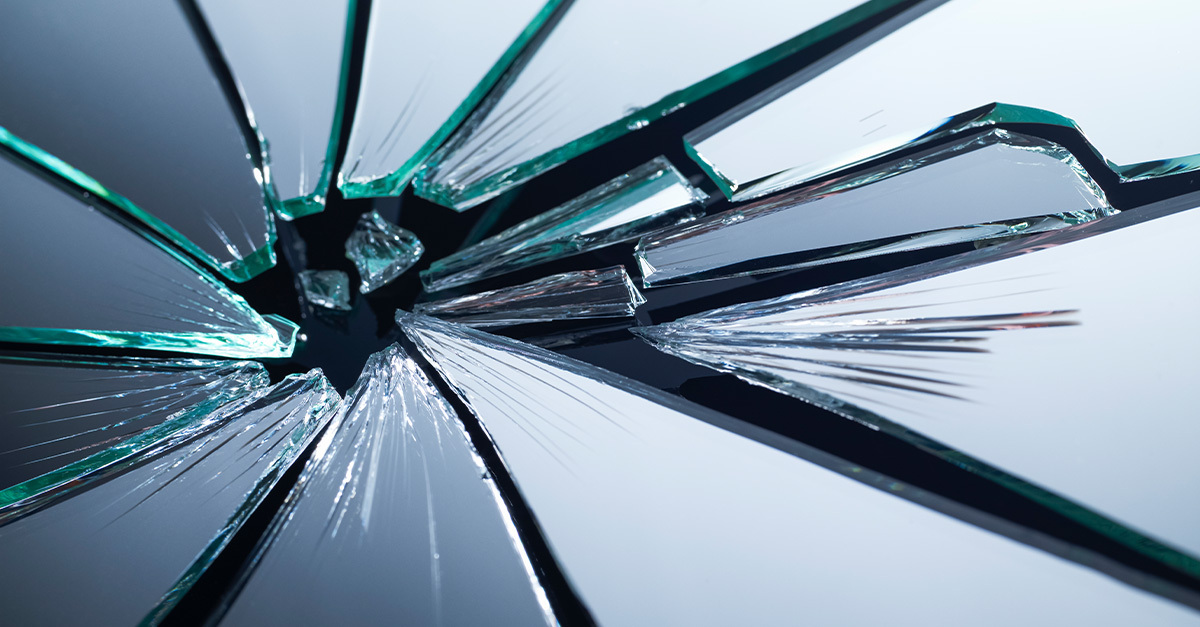

Drawdown is the mirror image of accumulation in so many ways, and treating it as anything other than that breaks the mirror and is potentially hugely damaging to the financial wellbeing of retirees. The real danger is retirees running out of money, so making sure the right approach is taken is vital.

We call upon the industry – advisers, fund managers and pension providers – to act on a simple and achievable 5-point plan (below) to fix what we believe are systemic problems of not acknowledging and, crucially, not working on the understanding that what’s good for drawdown is the opposite of what’s good for accumulation. We firmly believe that the industry getting behind our initiative would improve consumer outcomes, which is ultimately what we are all here to do.

Collaboration and discussion

To that end, we brought together representatives from the Association of British Insurers, The Pension Regulator, and the Pensions & Lifetime Savings Association - as well as drawdown experts from a broad range of providers and adviser firms - and we put it to them that there is a lot that they need to fix. We then asked for their candid views on whether they believed our action plan stood up to scrutiny and whether it would go some way to securing better consumer outcomes.

In the chair was the serving chairman of NEST (National Employment Savings Trust), Otto Thoresen, who has been heavily involved in advising government and regulators on consumer issues.

The upshot is that there is a clear consensus in three areas, which chime with the main themes in the white paper:

- The current approach (of re-purposing accumulation solutions for drawdown) has significant flaws. Drawdown-specific solutions would benefit from being ‘blended’. The regulatory advice boundary should be reviewed to enable hybrid digital solutions that incorporate a human ‘sounding board’ element at the end of the process. Hybrid products should include a combination of early drawdown and a deferred annuity element.

- There is a pressing need for a concerted adviser education drive to clarify the impacts of the broken mirror effect on drawdown and what advisers can and should do about them.

- Getting the regulators to engage with these issues now is crucial. This is yet to become a burning problem, but it’s only a matter of time before that happens. While benign markets will have disguised many failings in financial plans to date, volatility will inevitably return at some point, exposing those failings. Sadly, by then, the damage will have been done and, in the process, perversely evidencing just how disastrous the broken mirror effect can be for retirees.

Without exception, there was a genuine desire to improve drawdown and innovate to meet consumer needs around the table. Our 5-point action plan is just the start. We’d love to see the industry as a whole embrace it and then ramp up its lobbying efforts to ensure regulation doesn’t snuff out any hope of making hybrid drawdown solutions a reality.

Suppose you’d like to find out more about what shape those hybrid solutions may take. In that case, you can view the roundtable discussion in full here.

Our 5-point action plan for the industry, the starting point to fixing drawdown

- Tailor risk questionnaires to the needs of those drawing an income. It is inherently damaging to use accumulation attitude to risk questionnaires for retirees looking to use drawdown to provide an income because the attitude to the wrong risk is being measured.

- Ensure risk is explained in terms of the impact on a sustainable income. For example, investment volatility should not focus when presenting the risk of investment options for drawdown.

- Risk rate funds and portfolios are used for income drawdown in terms of income sustainability. Capital at risk should not be the primary focus.

- Provide retirees with income reviews annually and at times of severe market dislocation.

- Recognise that the FCA’s illustration rates are entirely unsuitable for determining drawdown income levels. This is because the rates are reviewed too infrequently to reflect current investment conditions and were not intended to be used for this purpose.

So what next?

The Drawdown: The Mirror Image of Accumulation white paper is available to download now and covers a plan that reaches across financial advisers, fund and asset managers, and pension providers.