In this blog, we explore the definitions of risk appetite and capacity for loss and explain how technological developments help you articulate their importance to your clients.

When receiving financial advice, your clients will always be asked two essential questions: “What is your risk appetite?” and “What is your capacity for loss?” Though often considered two sides of the same coin, there are key distinctions between them.

Let’s start by unpacking what each measure means.

What is risk appetite?

Risk appetite, or attitude to risk, is less objective. It’s about how comfortable your clients are with sharp fluctuations in the chosen investment strategy and bullishness to taking financial risks to meet defined investment goals. It tends to be flexible and often changes when transitioning to different phases of the investment cycle. Typically, people are willing to accept greater investment risk at the start of accumulation than in decumulation.

What is Capacity for loss?

Capacity for loss determines whether your client has sufficient assets and income to maintain their desired lifestyle. Effectively, how much they could absorb before their finances would be severely affected. It’s a fact-based approach and can therefore be calculated, often narrowed down to a specific number. Notably, the capacity for loss doesn’t mean permanent loss.

Both measures underpin the suitability process. A client’s investment strategy, whether accumulating or decumulating, must be constructed around them. The regulatory requirements here are outlined in the FCA handbook under COBS 9A.2.1.

It states investment advisers and portfolio management firms must obtain the necessary information from a client about their ability to bear losses and identify their risk tolerance.

What can we do to help to assess clients' risk appetite?

As an industry, we must continue to develop new ways of obtaining accurate data from clients while ensuring the process is as painless as possible. Assessing your client’s attitude to risk and other investment risks form the basis of understanding your client’s willingness to take financial risk.

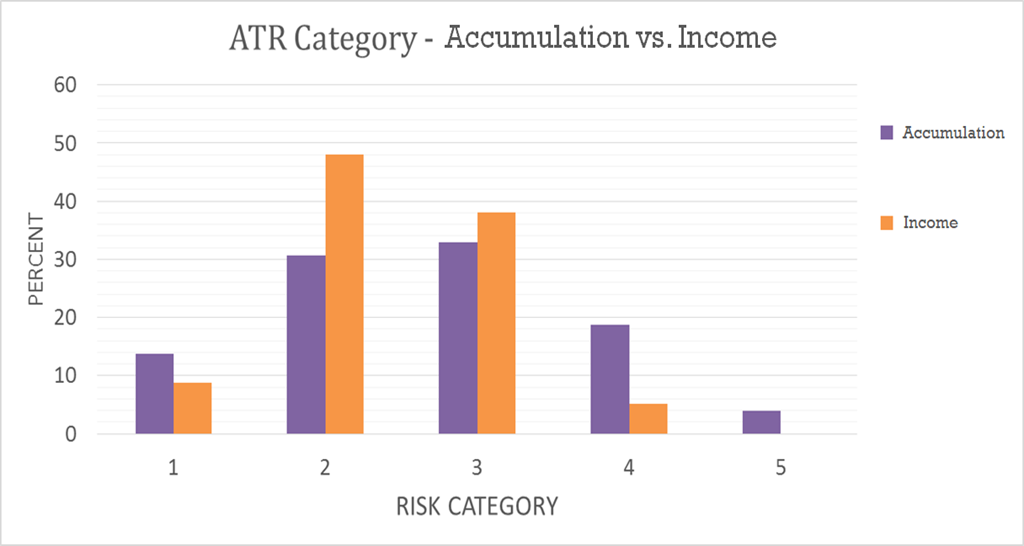

As part of our ongoing research, we compared consumers’ responses to our accumulation and income risk questionnaires. The results show a significantly more skewed distribution towards caution where income is a risk compared to capital.

Let’s look at the respondents’ age distribution. We see that while consumers looking for income are more risk-averse overall, the distribution of risk profiles by age for investment and income are very different. This is unsurprising since consumers accumulating wealth face very different risks and challenges to those drawing down income to live in retirement.

So, it’s your client's objective that should determine your attitude to the risk profiling questionnaire.

What next?

Recent improvements to the financial planning process have helped us achieve this by harnessing new forms of technology, delivering suitable financial advice, and ensuring your clients’ best outcomes.

Enhancements to both risk profiling and cashflow planning tools enable us to gather rich and accurate information on individuals’ risk appetites and loss capacity. This data can then establish a suitable investment strategy with asset allocations tailored to the investor’s preferences. By doing so, you have the reassurance that you’re doing what’s best for your clients while meeting your compliance obligations.

To learn more about risk profiling and how it can enhance your advice process, read; The Ultimate Guide to Risk Profiling.