Increase your customer engagement with a digital retirement planning solution

The introduction of pensions freedom in April 2015 gave people greater flexibility in managing their retirement pension pot. However, with this came greater responsibility, as individuals were now required to actively engage with their pensions to ensure they’re making the right decisions.

With the greater freedoms comes more complexities, as people with limited financial knowledge may struggle with where to start. And worse still, they could put their pensions and financial security at risk by going through and attempting to manage their pensions themselves. The demand for financial advice has never been greater, but not everyone can afford to access it. This has made people even more susceptible to making wrong financial decisions. And nowhere is this more apparent than with income drawdown.

We believe that the best way to help your customers overcome these challenges is to use digital technology solutions to bring these concepts to life.

Technology can help individuals better understand how their future retirement plans can take shape and what they need to achieve their financial and retirement lifestyle goals.

Increasing engagement with pensions among scheme members not only benefits the consumer but also encourages more pension contributions, boosting revenue from these increased assets under management for the pension scheme or workplace benefits provider.

What can you do?

Giving people foresight into their future finances is the only way to prevent financial mistakes. But how can employers and pension providers do this engagingly and affordably?

We believe these steps can help:

- Better education of the benefits of pensions

- Education around broader financial issues

- Simple language with no jargon

- Appropriate technology use

- Individualised communications

An interactive, personalised solution can overcome inadequate workforce engagement barriers and help non-advised people understand their pension complexities. These solutions can often communicate key messages more effectively than their traditional counterparts. So, people are more likely to educate themselves and make better-informed decisions.

Technology is key to delivering this simple, personalised communication – especially to large groups of people in a cost-effective way.

Customer success story

Working in conjunction with our long-term partner Buck, a leading consulting, technology, and administration services firm specialising in pensions and employee benefits, we are delighted to be able to announce a dramatic increase in member engagement.

Data gathered from across their pension schemes show the positive impact of digital solutions in increasing engagement with pensions among scheme members.

The statistics from 2020 — collected from over 165,000 pension scheme members who have online, real-time access to their scheme benefits through Buck’s digital portal and animated pension summary tool — show that engagement among members increased to between 30% and 40% on average after the launch of a digital portal providing access to pension benefits, compared to an intermediate industry engagement level of around 10%.

Schemes that have adopted a digital solution for members to gain real-time access to their pensions have also seen a dramatic increase in member contributions within three months of launching the solution. Typically, schemes have seen the number of members increasing their contribution rate double. In some cases, it has increased by over 130%.

Buck launched its DC animated pension summary tool in the U.K. and the Republic of Ireland in 2020. The new digital tool was the first of its kind in the market, supplementing traditional paper statements, giving scheme members any time access to an animated real-time summary of their pension pots.

Over the last year, Buck has also developed and launched 25 member portals, opening up its technology to an additional 90,000 scheme members, meaning 75% of members Buck serves now have access to online technology.

The animated summary aims to boost engagement from scheme members by providing them with a clear view of the last 12 months of pension contributions and allowing them to track their progress against their future retirement financial plan. If members are not on track to meet their goals, the tool also provides recommendations for simple changes to ensure they don’t miss their targets.

The range of tools can also be used to support any communications exercises that schemes undertake and ensure members can stay on top of their pension savings all year round.

Gary Wheeler, Chief Commercial Officer at EV, commented:

“Buck’s status as a market-leading pension administrator makes them a fantastic partner to work with to bring EV’s technology to the market. We’re really excited that Buck has been able to evidence more scheme member engagement and that this has led to an enormous increase in contributions. Ultimately, both EV and Buck strive to deliver the best possible experience to clients and scheme members. By delivering new tools and new benefits for pension schemes that drastically improve transparency for their members, it’s really exciting to be able to demonstrate such a positive impact with these solutions in the pensions space.”

Lee Cook, Head of Outsourcing at Buck in the U.K, commented:

“Member engagement has always been a challenge for schemes. In the last year, many members have moved into a more physically isolated environment, meaning the quality of member communications is more important than ever. And effective technology has been the lynchpin in enabling employers to continue to deliver on the social contract.

“Digital solutions that involve members and ‘nudge’ them towards interacting with their pension are a huge step forward in engaging individuals, both at the day-to-day level and in conjunction with any specific exercises schemes may aim to undertake. The tangible success we’ve seen using Buck’s animated pension summary tool with our clients is demonstrated by the increase in member engagement, rise in contributions, and decrease in the risk of under-funding.”

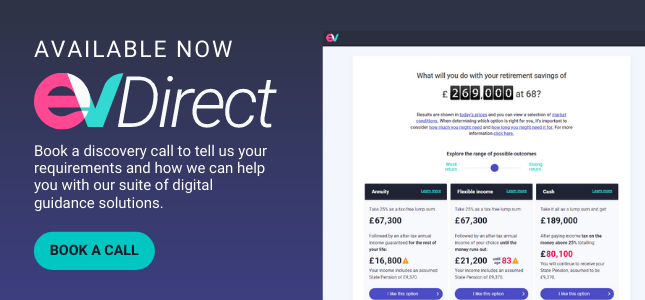

Learn more and get in touch with EV

Start your journey to improve member engagement, increase member pension contributions, and give your business the digital solutions to stand out in the marketplace.