How efficient is your income sustainability strategy?

Retirement income sustainability is a hot topic. Drawdown forms a major part of your clients' financial plan as they move from accumulating assets to drawing income.

In most cases, consumers, whether taking advice or not, share the same objective: income sustainability. To clarify, by sustainable, I mean an individual continuing to withdraw the required level of retirement income for the required period.

There are risks specific to drawdown, such as sequencing returns and pound cost ravaging, and yet to date, and there has been no specific process to discuss, plan and evaluate the efficiency of a drawdown strategy or assess a clients attitude to income variability.

Attitude to Risk or Attitude to Income Risk

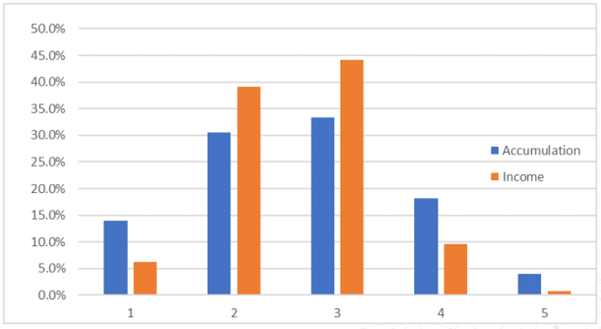

When questions are focused on a clients attitude to the sustainability of income in retirement, the distribution of risk profiles differs from the results of a standard accumulation based model.

Understandably consumers want less risk in the variability of their income stream. However, this is different to the clients' attitude to risk whilst in the accumulation phase, and therefore, the questions should be specific according to which objective the client has.

Below we outline some sample scenarios from EV’s income risk profiler – the equivalent of a standard risk profiler used for accumulation but focused on your clients’ attitude to income risk, i.e., the income sustainability or variability.

- I would prefer a lower guarantee income to a larger uncertain one

- I would worry if I could not be sure how much income I might get every year

Risk rating tools must focus specifically on drawdown as an objective and consider the inherent caution expressed by consumers and the specific risks associated with income drawdown.

Value/Income-at-Risk

Value-at-Risk (VaR) is a measure that has become the industry standard for determining market risk across asset classes. It is an estimate of the worst possible loss a portfolio might suffer due to changes in market rates and prices over a specified timeframe to a degree of statistical confidence.

For the consumer, VaR is about their odds of losing money. By assuming investors care about the risk of a large loss, VaR can answer questions like "What's my worst-case scenario?" or "How much could I lose in a bad month?".

Historical Value-at-Risk is calculated using past returns and works incredibly well to open discussions with clients around their Capacity for Loss and Attitude to Risk, especially when expressed in monetary terms.

For example, If the 1-day 95% VaR for a portfolio is £5 million, then there is a 95% chance that the portfolio will not lose more than £5 million, and a 5% chance that it will lose £5 million or more.

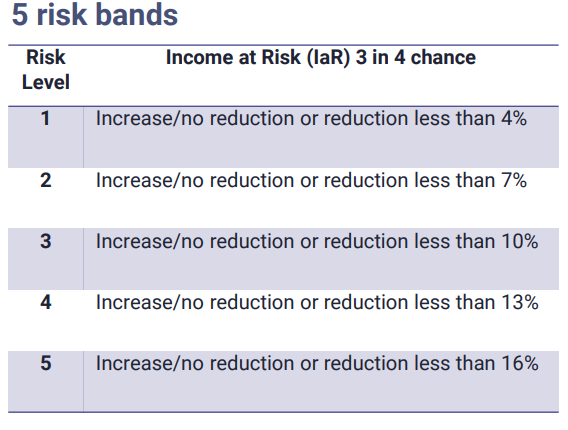

For decumulation models, we use the concept of Income-at-Risk (IaR). This is a ratio that expresses the acceptable ratio of downside to sustainable income.

IaR quantifies potential downside risk and facilitates discussions about Capacity for Loss in a drawdown scenario.

In a 5 Risk band model, at level 2, there is a 3/4 chance of an increase/no reduction or reduction less than 7%.

Therefore an annual income of £16,500 could suffer a downside variation of up to £1,155.

Consumers can engage on their level of comfort with this variability - particularly downward adjustments and move to find the most suitable fund for delivering income at the defined level of risk.

How do you assess a fund's ability to deliver income?

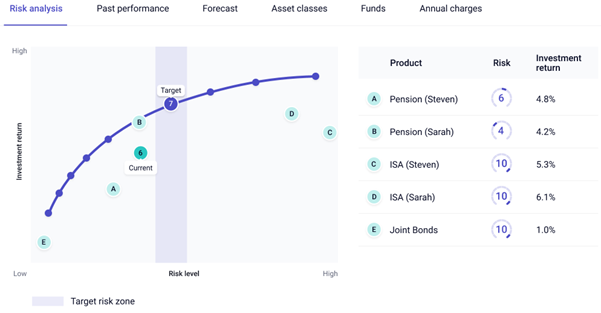

With accumulation funds, plans and portfolios, we’re accustomed to using the efficient frontier to help highlight the effectiveness of delivering returns for a given level of risk.

It's important to help identify and prove that the most suitable fund has been chosen when considering the clients' growth needs.

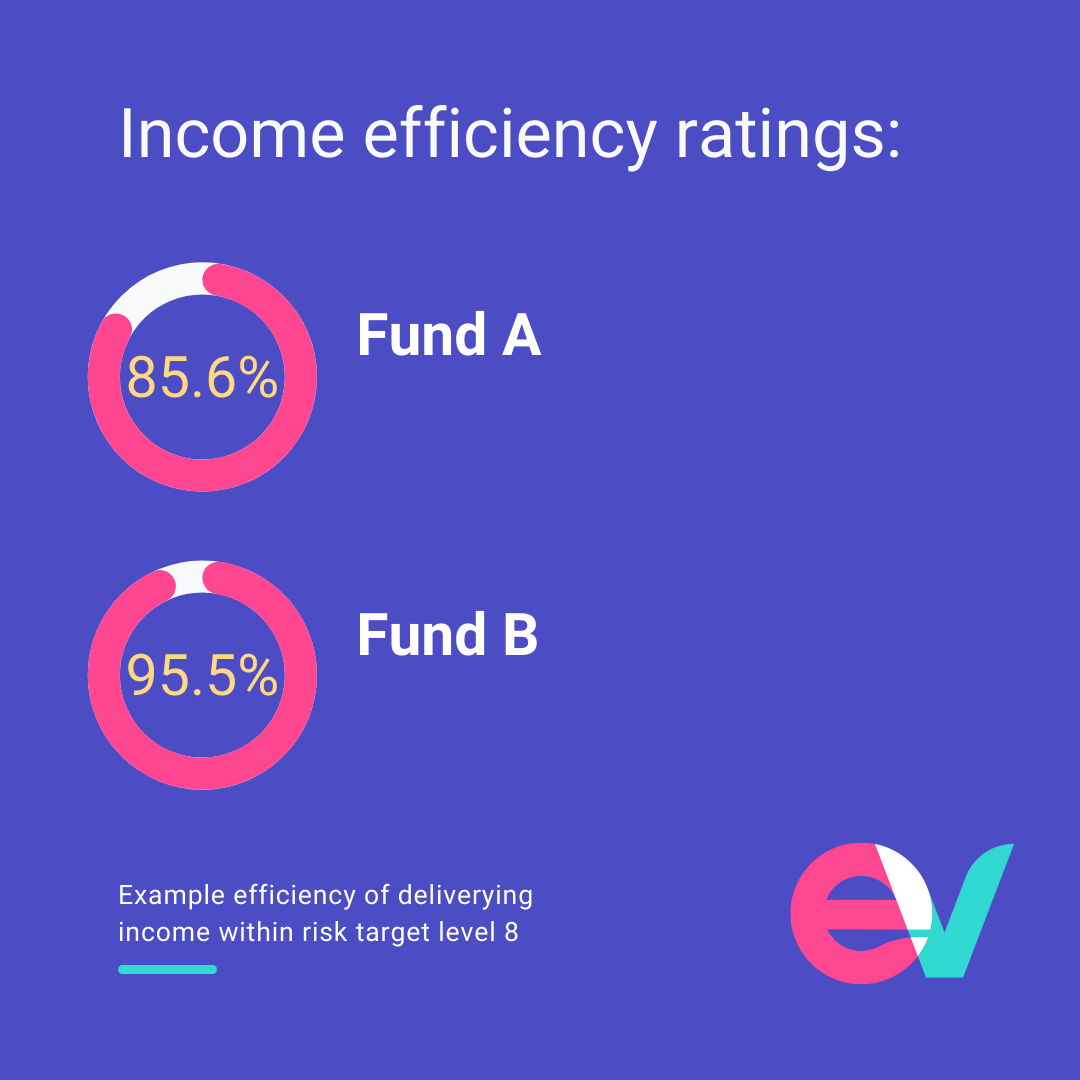

The same analysis can be done for funds delivering an income – there is a different efficient frontier that focuses on maximised income for a given level of income risk.

We can use this to show how close to efficiency the fund or portfolio is and help identify and prove that the most suitable fund has been chosen when considering the clients' income needs.

Review and Revisit

For an adviser, there are some clear benefits to be had by analysing a clients attitude to income variability in this way;- Address the issue that for investors looking to take an income, nearly all attitude to risk questionnaires are based on the risks associated with accumulating assets and not on drawing an income;

- Ensure income-related risks such as "sequencing" and "pound cost ravaging" are taken into account, as they are ignored in the current growth focussed fund risk ratings;

- Match clients’ attitude to risk for income precisely to consistently risk-rated funds and portfolios;

- Assess how good a fund is at delivering income;

- Facilitate the assessment of capacity for loss by quantifying the potential downside that retirees may experience in their income;

- Identify and prove that the most suitable fund has been chosen when considering income needs.

Arguably, the more important takeaway is the ability to provide your clients with a simple method of understanding how they feel about variability in the level of their income at retirement.

Expectations and objectives can be discussed, set and reviewed in a robust and repeatable way.

Conclusion

In this article, we've discussed the importance of understanding how your prospects feel about variability in their income level at retirement. The more you know about how they think and feel, the better you'll determine what products or services will best serve them.