Hybrid financial advice: The perfect blend of human and digital advice to provide valuable customer journeys

In this blog, we discuss what hybrid financial advice is, how hybrid advice can provide value for your clients and how you can achieve the perfect balance between digital efficiency and the human touch in your advice process with EV.

The financial industry is changing rapidly, with traditional financial adviser models needing to be updated to keep pace with clients ever demanding expectations. With advancements in financial technology making it easier than ever for consumers to gain financial advice, a new model of financial advice is on the rise: the ‘hybrid’ financial advice model.

According to leading global management consulting firm, Oliver Wyman, “digital-first and hybrid propositions will gain popularity across all client segments, and wealth managers who are not preparing for this change will fall behind. Wealth managers need to provide hybrid propositions that combine human-advice access with a top-shelf digital client experience.”

What is hybrid financial advice?

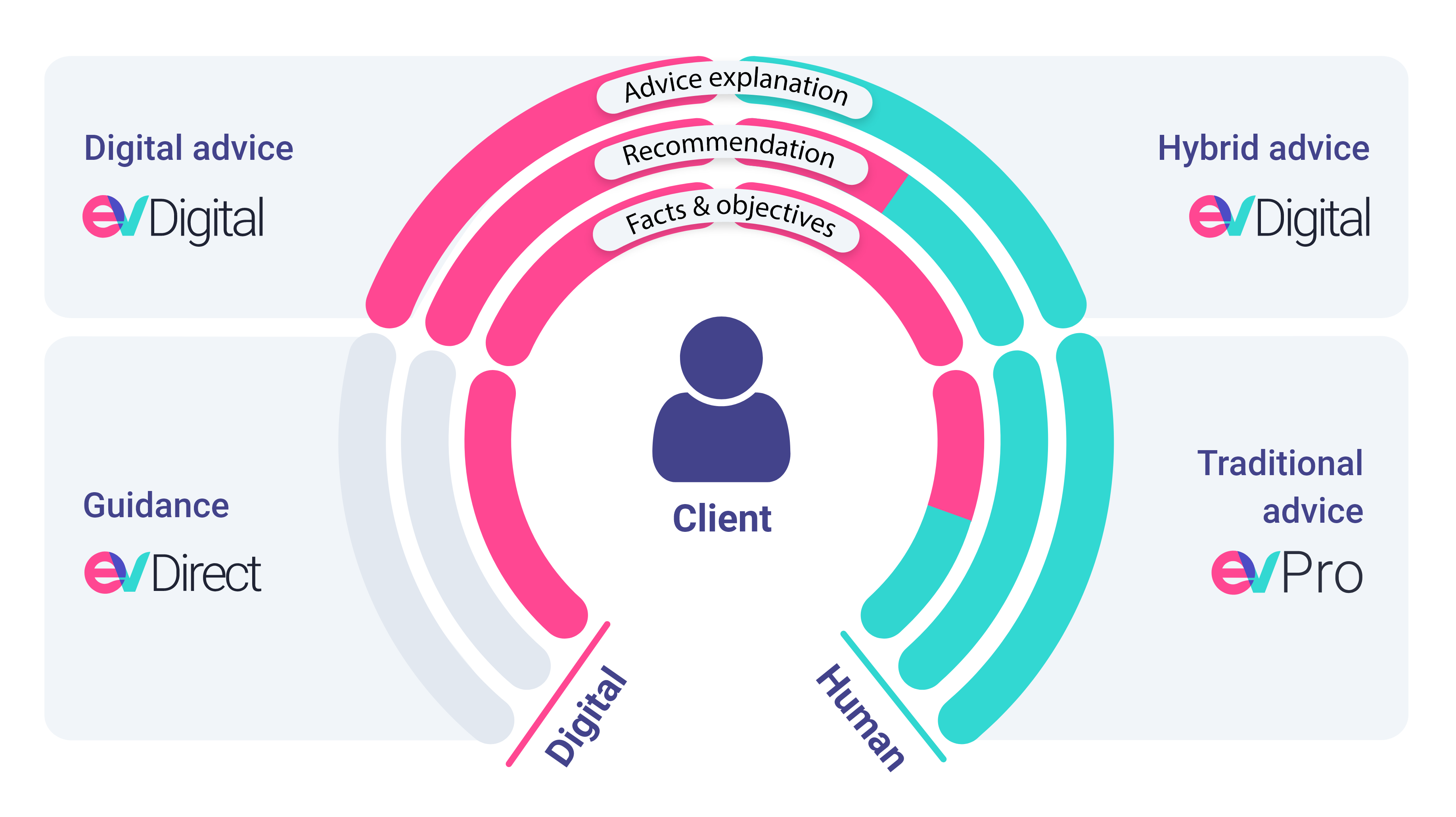

Hybrid financial advice differs from traditional financial advice because it utilises a digital advice framework that increases automation when developing client solutions. On the other hand, the traditional financial advice approach fully relies upon the adviser to deliver the financial advice.

Hybrid financial advice sits between digital and traditional advice to enable your clients to move seamlessly between these options according to their specific needs and preferences. This ensures their advice needs are met, with input from advisers being used when needs become complex.

What is the value of hybrid financial advice for customers?

As opposed to relying on a strictly digital or traditional approach by combining all methods, the hybrid approach provides a better overall client experience, ensuring their needs are met flexibly. The hybrid approach has many benefits, including closing the financial “advice gap”, providing access to advice 24/7, giving clients the option to speak to an experienced adviser, and meeting their needs as they progress through the different stages of life.

We delve further into these key benefits of the hybrid financial advice model for your clients below.

Close the advice gap by offering cost-effective service

A recent financial times article highlighted that 13 million people in the UK are in the “advice gap”, unable or unwilling to pay the high fees of financial advisory services.

The hybrid approach decreases delivery costs by reducing human advisory input, which is typically only affordable for high-net-worth individuals with specific needs. This helps to close the ‘advice gap’ for consumers making financial advice more accessible for your clients while enabling you to widen your target market and tap into additional market opportunities for your business.

%20(2).png?width=1200&height=627&name=Blog%20Advive%20Gap%20(1200%20%C3%97%20627%20px)%20(2).png)

Meet consumer demand for easily accessible and readily available advice

Consumers want accessible, straightforward financial advice to help better understand their current and future financial situation, whether that is obtained from a fully digital advice solution, hybrid advice with some human oversight or fully-fledged traditional advice from a financial adviser.

Through hybrid financial advice, you can effectively meet your clients’ financial advisory needs without a large degree of human input from your wealth managers. Through providing hybrid advice, your clients have access to service 24/7 through the self-serve digital element, with the comfort of speaking to a wealth manager if they want or need to, with the ability to transition into traditional advice. This reinforces the flexibility of the hybrid advice model, ensuring the advice is delivered in a way that makes the most sense.

Hybrid financial advice gives people the security of speaking to a human

Depending on the level of financial advice required, clients often would like to speak to a human to gain high-quality advice that both meets their needs and that is relative to more advanced advice journeys. People trust people, and therefore the security of speaking to a human being reinforces the value of a hybrid financial advisory approach.

Solution providers such as EV help advisers create a good client experience by helping firms understand how to create a solution that enables them to deliver their advice process in the most useful way. For example, we can outline where the transition should take place for an adviser to intercept the digital and provide that extra level of human support needed.

Having the same advice firm throughout their lifetime

Offering your clients a flexible advice solution ensures you can meet their advice needs as they progress through life and grow their wealth. Whilst they may need less adviser input earlier in their journey, you can offer them increased levels of support when this is eventually required. Furthermore, maintaining client relationships ensures you have a better understanding of their problems, creating a seamless financial advice process and better solutions for your clients.

How you can get the perfect balance in your process with EV

When striving to achieve the perfect balance in your process, it is important to recognise that the right level of support depends on the type of advice and the service you want to offer. To get the balance right, it is important to view hybrid financial advice as an interchangeable client journey, ensuring that the level of support provided is relative to the complexity of the client’s problem.

Where hybrid advice fits in the end-to-end customer journey to get the right balance

Providing a hybrid element to your advice processes enables you to serve value to your clients by offering the correct level of service when they need it.

Whilst a fully digital advice route may be appropriate for certain clients with simplistic advice needs without progressing to a more advanced level of support, the process is dynamic, as clients require different levels of support available when their needs change.

For example, the client may start their journey by themselves through guidance, but their needs may be more complex than originally thought. Therefore, they may need to move from guidance level support to self-serve advice, followed by hybrid advice, and then adviser-led advice. This demonstrates how clients can progress through the different levels of support to ensure their advice needs are met, whatever their problem.

Not only this, but balancing how the adviser can use technology throughout the end-to-end advice process is crucial to creating a hybrid approach. For example, facilitating the support of digital tools during the fact and objective, and recommendation phases enables the process to be carried out more efficiently, quickly and comprehensively with more plausible forecast outcomes that have taken into account more variables.

The adviser then can transition into a more traditional role taking these recommendations and being able to take more time building on the analysis to provide a more consultative explanation that provides the client with a higher quality of service.

How to use hybrid financial advice for the right advice path

When we refer to the complexity of advice, we are relating this back to the type of advice the client is seeking.

For example, clients with simple advice problems, where they can solve their advisory needs and gain advice without any adviser intervention, would be those looking to receive ‘guidance’ or ‘advice’ about simple investments such as an ISA investment. They may begin by educating themselves through researching ISAs to gain information on the options around this investment and then move onto digital self-serve advice to gain recommendations on what out of these options is best based on a suitability report generated by algorithms.

For clients with more complex needs, such as the acquisition of financial protection, equity release, pension consolidation, or inheritance tax, increasing adviser support will be necessary. A hybrid approach allows your clients to gain guidance first on these areas to educate themselves before going into a more traditional path to gain recommendations on the outcome that is right for them.

Another way this can help your clients is when considering a lifetime journey. For example, when they are younger with less money, they will have more simplistic advice needs. Therefore, little to no adviser help may be needed. However, suppose the person acquires wealth as they progress through life. In that case, they will require more in-depth, personalised advice, so hybrid or adviser-led advice will be necessary for that individual. The lifetime approach emphasises developing a long-term client relationship, enabling you to meet their needs effectively at every phase of their financial lives with the help of a hybrid advice approach.

The diagram below demonstrates the merging of digital and human advice, and how clients will likely need a combination of both through their journey, which is why a hybrid approach is key to ensuring you can serve clients efficiently in all circumstances.

Summary

As you can see, hybrid financial advice has numerous advantages for your clients and your organisation. The agility of hybrid financial advice allows you to provide excellent client experience and expand your target market without excess effort by offering the right level of client support depending on their evolving advice needs.

Here at EV, we can help you find the right balance between digital, hybrid, and traditional advice by providing a consultative approach to enable you to create a process that outlines the transition between the elements based on the advice path.