Achieving your firm’s performance goals with EV’s hybrid financial advice model

.png)

In this article, we unpack the hybrid financial advice model, how it can help your firm achieve its performance goals, and how EV’s solution can help you embrace hybrid financial advice in your process.

With pressure to deliver affordable financial advice profitably, growing numbers of advisers and wealth managers are exploring a hybrid financial advice model to help meet market demand and achieve their firm's performance goals.

Ernst & Young’s last Global Wealth Research Report revealed that 35% of wealth management clients preferred adviser-led advice, 28% favoured digital-led advice, and 37% sought a combination of both. So, it’s no wonder firms are increasingly taking a hybrid advice approach.

What is the hybrid financial advice model?

The hybrid financial advice model allows you to deliver advice through a traditional method, a blend of online fact find and face-to-face advice recommendations. It typically includes a combination of online tools and software and access to a human adviser who can provide personalised guidance and advice, enabling clients to move seamlessly between these options according to their specific needs and preferences.

Using the hybrid approach can provide investors with both the convenience and efficiency of technology-based advice combined with the personalised touch and expertise of a human adviser. As a result, this ensures your client’s advice needs are met, with input from advisers being used when the client’s needs become complex.

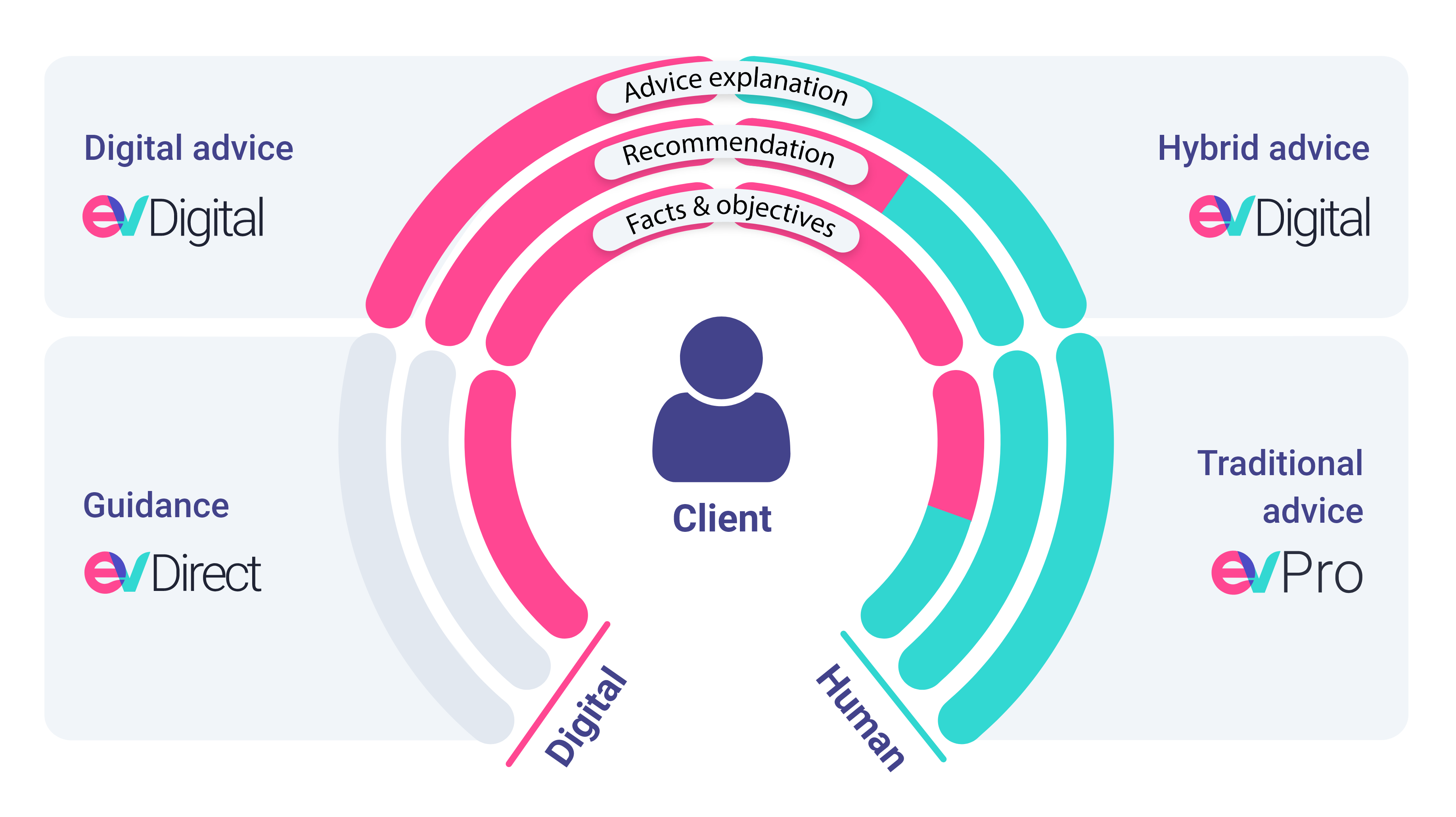

As highlighted in the graph below, hybrid advice fits between purely digital and traditional in the end-to-end advice journey, where advice is provided by a combination of both adviser input and client interaction in an online system, depending on the specific needs of the client.

How will a hybrid financial advice model help your business achieve your firm’s performance goals?

A hybrid financial advice model can help your business achieve its performance goals by combining the benefits of both human and automated advice. Human advisers can provide personalised, emotional support and in-depth knowledge, while automated systems offer 24/7 availability, scalability, and cost efficiency. This combination can help your business to achieve your performance goals, including expanding your market share, reducing client turnover and improving overall efficiency.

Expand market share

Using this blended financial advice model can increase your market share by providing consumers with more accessible and cost-effective options for managing their finances. Combining technology with the support of a human adviser allows them to receive financial guidance while also having the ability to make their own investment decisions. As a result, self-serve and hybrid financial advice models can expand the market by attracting a wider range of clients, including those who may not have previously sought financial advice due to cost or accessibility barriers.

In addition, the self-serve element of the hybrid model allows you to reach a younger demographic with simple needs, enabling your firm to expand your market to those that desire these new services. And as these clients’ advice needs become more complex over time, this will also lead to a higher market share through client retention.

Reduce client churn

Because the hybrid financial advice model enables you to offer services that cater to the market's earlier needs, you will be present throughout their financial life events and triggers. This approach can help reduce client turnover by providing clients with a personalised experience that meets their specific needs and goals. For example, the digital advice element can provide quick and easy access to investment information and tools. In contrast, human advisers can provide guidance and support when clients have more complex or unique financial situations.

Additionally, with the aid of technology throughout the process, this increases adviser efficiency, helping to facilitate increased service quality. This is possible as the adviser can use the time that would have been spent on admin to provide thorough recommendations and deliver a more personalised experience for the client.

Improve the efficiency of the adviser in carrying out the end-to-end journey to reduce the cost of delivering the service

Hybrid financial advice can help you to improve the efficiency of the adviser in delivering financial advice by freeing up time for the adviser to focus on more complex tasks such as providing personalised advice and building client relationships. This can help to reduce the cost of delivering the service by reducing the need for manual labour and helping advisers provide more efficient and cost-effective services to clients.

For example, the adviser can get the client to fill out a fact find ahead of the meeting, allowing them to go into more detail during the meeting. Plus, using technology to create the forecast outcomes means you can reduce the time it takes to create the proposal, allowing more time for analysis and better client outcomes overall.

How EV’s hybrid financial advice model can help you meet your firm’s goals

At EV, we utilise the realistic stochastic methodology to underpin our hybrid advice model because it is not enough to show risk projections on a risk scale without making allowance for the fact that markets are complex, irregular and ever-changing. To achieve meaningful insights, it is vital to put risk and reward into the context of what it means for the client, reflecting real-world economic scenarios that provide a range of possible outcomes your client may experience and the relative likelihood of each.

Through the use of the stochastic model to underpin our hybrid financial advice solution, clients can understand the risk and rewards of their investments by delivering personalised outcomes based on realistic risk and reward descriptions that show the range of returns that could apply based on the client's specific and individual objectives.

As a result, your clients can expect better investment returns based on effective decision-making.

Summary

So that your firm can achieve its goals, EV can help you begin your digital advice transformation by helping you to find the right balance between digital, hybrid, and traditional advice. If you haven't done so already, read our useful guide to embarking on a digital advice process here.

We provide a consultative approach to enable you to create a process that outlines the transition between the elements based on the financial advice path and where the triggers should take place for an adviser to intercept the digital and provide that extra level of human support needed.

As a result, you will be able to better meet your clients’ needs leading to better overall satisfaction with increased organisational efficiency allowing your firm to expand market share, increase client retention and improve adviser efficiency leading to reduced service delivery costs.

If you'd like to learn more about transitioning to a hybrid financial advice model within your organisation, contact our expert team today.