Buy or build a SaaS digital advisory service? How to know what’s right for you

%20(5).png)

In this article, we outline the key considerations when developing a digital advisory service, including the different build routes, when and how to incorporate software-as-a-service (SaaS) and the integrations to consider to ensure the solution meets your firm's needs.

Firms have various options available to them. These vary in the level of control, resources required and expertise needed to execute them. Overall the choice of which route to take will depend on your firm's current challenges, future goals and strategic objectives.

Digital advisory service build and development considerations

The need for digital advice solutions is growing in line with consumer demand for more convenient and accessible financial planning advice. Digital advisory services are filling the space between DIY investing and full-service financial planning advice, known as “the advice gap”. And as firms’ average client per adviser counts have been steadily increasing:

FCA data shows an increase from an average of around 90 to 115 from 2016-2021 - the need for streamlined solutions and digital advice tools, to manage some of the more time-intensive steps in the process, is clear.

Let’s look at the key considerations when planning your digital advisory service build, the different routes to take, and development requirements to factor into the project.

Different build routes and questions to consider before developing a digital advisory service

Whether you decide to use third-party APIs, an API modular approach or adopt a “buy-before-make” policy, there are various build routes when developing your SaaS digital advisory service. Below we outline the key questions you need to consider when deciding which route is right for you.

Do you have sufficient internal resources and expertise to take control of the user interface yourself?

When creating a digital advisory service, it’s important to understand your in-house development capabilities, how flexible your existing financial planning system is and how much control you want over the user interface (UI), architecture and maintenance.

The viability of building everything in-house (and the costs and risk involved) will be determined by the scope of your needs, timelines and future goals.

Do you want to use components and APIs from a third party whilst retaining control over the front end?

Building a digital advisory service using components and APIs from a third party will enable you to leverage existing technology and expertise and accelerate your time to market. Striking a balance between leveraging third-party tools and maintaining control over the front end allows the solution to be customised to meet your clients’ specific needs.

EV’s digital advice solutions (EVDigital and EVDirect) offer various components for the back-end and front-end to support your build and configuration to meet your varied requirements. This includes fact-finding and questionnaire set-up and inputs, advice algorithm and forecasting APIs, risk profiling, journey control, and much more.

Do you need a SaaS solution that is configurable to your needs?

As the needs and preferences of your clients will vary, a one-size-fits-all solution may not be suitable for your business. By having a configurable solution, you can tailor the software to meet the needs of your clients while still maintaining a consistent user experience.

EV’s SaaS offering, EVPro, is an end-to-end financial planning software solution that can be configured and extended to meet your digital and hybrid advice needs using the APIs and components mentioned above.

Do you want to use an app or a website?

Decide whether you want to incorporate your solution in a native app for Android or iOS, or if you need it to integrate with existing sites suitable for both mobile and desktop. The choice will likely depend on your current set-up, client base and project goals.

Our digital advice solutions are compatible across mobile phones, tablets and desktops, supporting Google Chrome, Firefox, Safari and Microsoft Edge browsers vendors.

Should you adopt a “buy-before-make” policy or an off-the-shelf SaaS solution?

Adopting a "buy-before-make" policy can help you to determine if a suitable solution already exists that can meet your needs, before committing to investing in developing a new solution in-house. However, when adopting this approach, in-house development may be necessary for integration with other systems or custom financial planning solutions via an API.

On the other hand, you can just adopt an off-the-shelf SaaS solution, providing faster time-to-market and lower development costs. To ensure this option is a good fit, you’ll need to evaluate the solution's features, scalability, security and integration capabilities with other systems and services.

EV provides both. You can either use our front-end as it is with a specific configuration, or you can use our APIs to build your journey. Alternatively, you can start with our existing solution and adapt it to your requirements, so you don’t have to build everything from scratch but still enjoy a degree of control.

Should you go for an API modular approach?

Adopting an API modular approach allows for greater flexibility and agility by enabling different service components to be developed and deployed independently, reducing development and deployment time. Secondly, this will promote scalability and modularity, enabling new functionality to be added or existing functionality to be modified or replaced without affecting the entire system. Thirdly, this will facilitate integration with other systems and services, enabling a more seamless and consistent user experience.

It’s important to bear in mind, there can be potential technical complexities involved, for certain integrations, to implement a full-service offering with the desired level of flexibility and useability.

Will the solution vendor be able to provide both API and front-end capabilities?

It’s important to know if the vendor can provide both API and front-end capabilities when building a digital advisory service. You need to enable efficient coordination and collaboration between the development teams and ensure more seamless integration between the front-end user interface and the underlying APIs.

Unlike other vendors, which only offer either API or front-end capabilities, EV can offer API and front-end capabilities, giving you extra flexibility when building your digital advisory service.

Do you have the internal team to maintain and update the site yourself or are you looking for support for this?

It's crucial to be clear whether you have the required internal resources to maintain and update the solution or need external support. The system’s performance may suffer without proper maintenance and updates, and its ability to deliver value to users may be compromised.

If you don’t have adequate in-house capabilities, EV can support you with this, working to resolve any issues and ensuring that your site is working at optimal performance.

Integrations included when building a digital advisory service

.jpg?width=641&height=428&name=technology-g64a320e39_1920%20(1).jpg)

When building an effective digital advisory service, consider the integrations you may need to ensure that the platform is effective and provides a seamless user experience. By integrating with various third-party solutions, the platform can offer users a more comprehensive set of features and capabilities they can access from a single location. Carefully consider which integrations to include in the build based on the needs of your clients and your overall goals for implementing the solution.

Here are some key integration questions to consider below:

How will it integrate with the tools being used within the current workflow?

Determining whether the solution will integrate with existing tools and systems will ensure that the data is consistent, accurate and up-to-date. It will also improve the overall efficiency of the workflow, and provide a better user experience.

At EV, we can help you decide on the third-party integrations you’ll need and the flow of data from existing systems, ensuring our solution seamlessly integrates with your current tools and tech stack.

Is single sign-on required to ensure security and seamless transition?

Single sign-on (SSO) is an important consideration, as this can protect security when building an automated financial solution by providing a centralised and secure authentication mechanism. With SSO, users only need to log in once to access multiple applications, which reduces the risk of weak passwords and minimises the likelihood of unauthorised access.

EV’s solutions provide SSO for seamless journeys into both the client portal and adviser solution, maximising solution security and facilitating seamless user experiences.

What quotations or illustrations need to be included during the user journey?

Considering the quotations and illustrations to be included during the user journey is important because they provide accurate and up-to-date information essential for informed decision-making. They also can enhance the client experience, ensure compliance with regulations and differentiate your service from competitors.

To provide the required advice, you should have a key information document and a product illustration. The question is how you get this. If it's just a standard investment, then a link to the fund info might be fine, but ideally, you’ll have a quote system integrated. If you're a restricted firm, then this is an in-house system, but for non-restricted advisers, you'd either need to decide your target market and limit your product accordingly, or you'll need a whole-of-market quote system integrated. And this may also depend on the type of advice offered too - protection is more likely to need a whole-of-market option to get the best price.

What other integrations might be needed?

Other integrations may be required to implement a seamless user journey. For some systems integrations, we use certain third-party software systems, such as for Identification and Verification (ID&V). If required, EV can work with other organisations to deliver these services.We currently use the following options:

- SmartSearch for ID&V

- Stripe for credit card payment facilities

- ESG Accord for ESG preferences questionnaire for detailed sustainability details

- Comentis for vulnerability questionnaires

- Calendar integrations such as Calendly

- ATEB for suitability report writer integration for advisers

- Live chat facilities for support during the process

Our existing clients have a wide variety of back-end bespoke and off-the-shelf solutions for platforms and back-office systems, which we’ve already integrated with using our APIs.

What are the tech stack’s integration abilities and partner connections?

The specific tech stack for your digital advice service will depend on your requirements, including scalability, performance, security and cost constraints. It’s important to determine if the vendor uses a data structure that ensures you’re not tied into a single integration.

EV will help you address whether you can build a custom in-house solution utilising APIs or whether buying an off-the-shelf solution will be more appropriate for your needs, and how to carry out the process for each route. We’ll also address the third-party integrations you’ll need and the flow of data from existing systems, to ensure the solution integrates smoothly.

What are the different implementation times of each route?

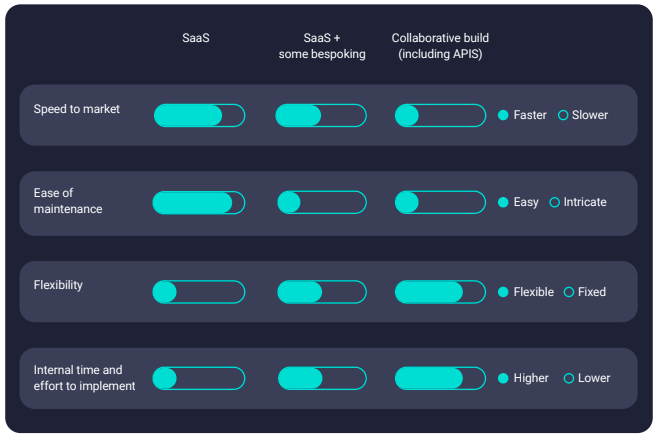

The time it takes to implement each of the routes will vary depending on several factors, such as the complexity of the solution and the resources available for the implementation. Whilst an off-the-shelf solution will be quicker to implement, an API modular approach will take longer.

It’s important to note that you can launch the solution in phases. For example, with EV, you can use off-the-shelf products to give a quicker time to market, then use calculation APIs in the user journey later down the line.

What should your build roadmap look like to scale?

To scale a SaaS digital advisory service, your build roadmap should focus on creating a robust and scalable infrastructure that can handle increasing user demand. You have to consider what you need beyond the first phase of delivery. For example, launching with investment advice but not being able to extend it to retirement because your tech stack doesn’t support it will cost more in the long run than choosing the right tech in the first place.

You should also consider how you want to grow and scale in the future and what these phases of implementation look like to ensure your build roadmap supports current and future needs. We hold quarterly and annual review meetings with our partners to review any client feedback, discuss the product roadmap and examine any consumer research that might lead to new product requirements.

Explore our digital advice framework and bespoke solutions for your digital advice solution build.

What are the cost differences between the build options?

The cost differences vary depending on factors like the complexity of the platform, the technology stack used, and the level of customisation required. It’s important to note that the more bespoke solutions have a higher cost (for implementation and ongoing maintenance) but offer more flexibility and control. Ultimately, the most cost-effective option will depend on your firm’s specific needs and goals.

The EV team will help you address which costs are baseline and which can be optional, plus where the costs will differ depending on the build route options for certain elements of the solution. This will give you full transparency on what you can expect to pay, with no surprises.

Summary

As you can see, there are numerous considerations when developing your digital advisory service. We hope this article has given you helpful insights into what approach might suit your business, the SaaS requirements during the implementation and the integrations you might need now and for the future.

To learn more about how EV can help your project, discover EVDigital, providing the option between our off-the-shelf SaaS solution and our suite of components to support your digital advisory service build. EVDigital offers an array of components, APIs and advice algorithms that can be combined to create a variety of journeys or build upon your existing platform, including self-serve, hybrid and adviser-led solutions.

Tailor your solution to your specific needs, connect our sophisticated financial planning tools for advisers and seamlessly integrate with third-party tools and services to enhance digital advice journeys and enable a hybrid financial advice model.

If you’d like further guidance on developing a digital advisory service, get in touch with our team today. We can offer guidance around embarking on a solution build and help you define your needs and the potential costs and timelines.