We are thrilled to announce the development inception for a digital consumer guidance Quick Tools suite by EVDirect. It promises to be an exciting period of innovation for the team, with a number of supplementary designs on the horizon to help your customer answer their financial questions quickly and effectively.

Consumers often get overwhelmed when presented with a holistic view of their finances. Most commonly due to too much financial jargon, the individual lacking in financial knowledge and confidence, or not understanding the impact their decisions can have on their financial future.

How Quick Tools can help your customers

With our growing suite of engaging Quick Tools, we aim to break this information into more manageable chunks, guiding the user into a more holistic view of their finances, ultimately leading to better long-term financial outcomes through better decision making.

With each Quick Tool, you will be able to help your customers answer specific questions about their finances, including questions around investments and retirement. We design each tool to be easy to understand with a focus on education.

In addition, through the power of our advanced UX/UI capabilities, you will have the ability to configure your brand styling and embed the tools within your existing journeys, ensuring you continue to provide a familiar, seamless customer experience.

Click here to learn more about our suite of Quick Tools.

How Quick Tools can help your business

Implementing our suite of Quick Tools as part of your customer service offering will provide your business with a host of benefits, including;

- Retention of more schemes and assets under management

- Encourage customers to save more due to a better understanding of their finances

- Improved customer engagement and retention

- Give your services the edge over your competitors

Using our direct to consumer guidance solutions to power a compelling customer engagement journey, we have seen over 4,500 users contribute on average £4,400 more per year to their workplace pension. That’s over £20 million in additional assets under management each year for your business.

Quick Tools in action

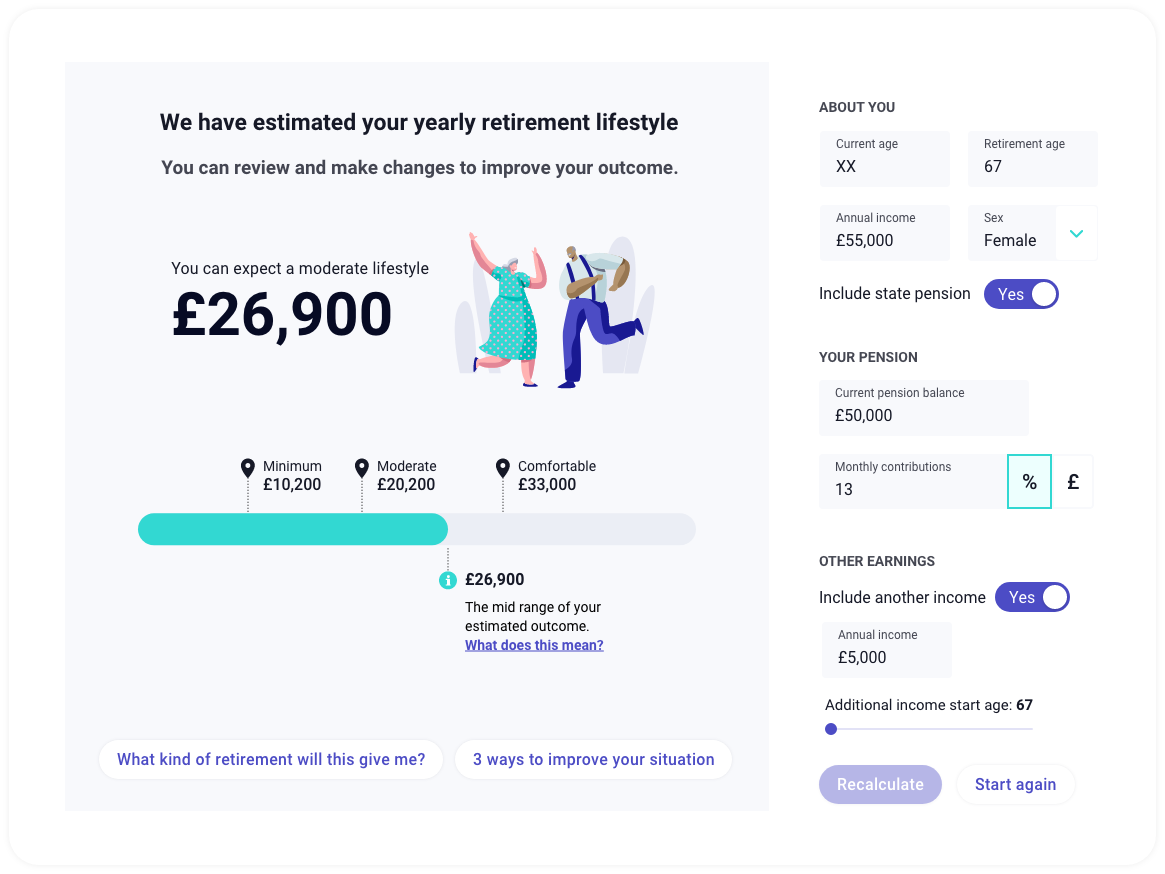

Each Quick Tool allows your customer to answer a specific question about their finance. Here is an example of one such Quick tool;

What lifestyle could I afford when I retire?

This Quick Tool provides customers with;

- A realistic expectation for their future financial position

- The support to make positive retirement decisions

- A relatable retirement forecast based upon the PLSA’s Retirement Living Standards

So what next?

At EV, we can support you on your journey to delivering a suite of digital consumer guidance Quick tools for your customers. Click below to learn more and book a call with one of our experts.

.png)