This blog explores the pitfalls of using short-term volatility to bridge client risk profiling and investment solution recommendations.

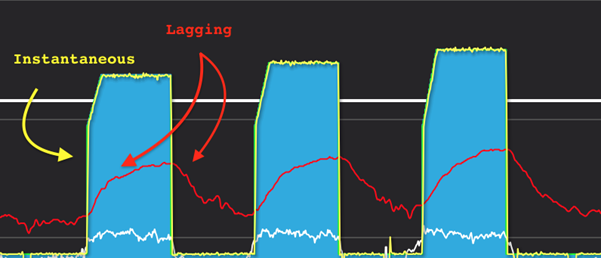

I’m on my road bike and I’ve reached the top of a punchy hill climb. Despite dropping the power that I’m applying to the pedals, my heart is still pounding in my chest. This is due to a lag between heart rate response and exertion change. The same cardiac lag is the reason that my heart rate did not start to rise until I was about 15 to 30 seconds into the start of the hill climb.

Lag

Heart rate can be viewed as a ‘surrogate measure’ of power – it does not have a guaranteed relationship with the present moment. It is controlled by the involuntary (autonomic) nervous system providing a view of the stresses the body has experienced in the past.

This makes pacing short high-intensity intervals very difficult – it is impossible to fully understand how hard you’re riding during short efforts, as your heart is playing catch-up.

For me, this ‘catch up factor’ could not provide a better analogy for volatility and its use as a measure of risk mapping and assessment.

Suitability

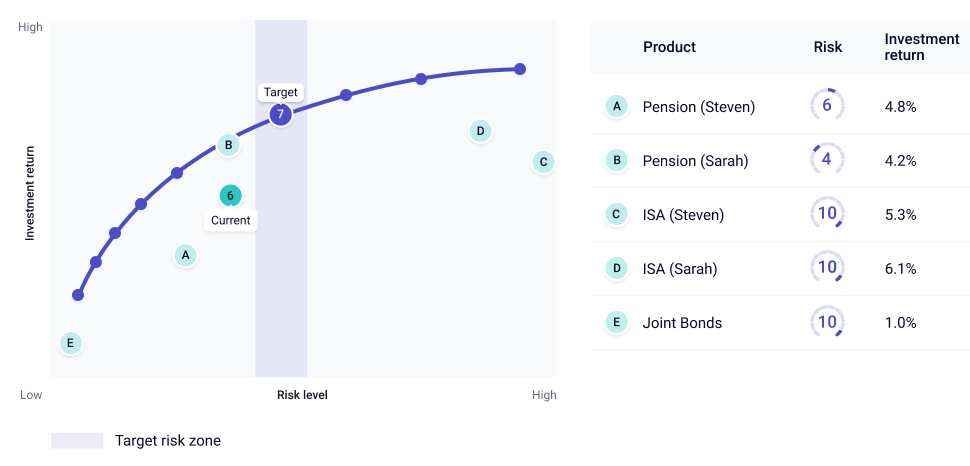

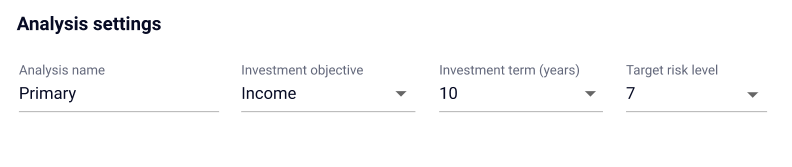

Say that I want to be able to track the appropriateness of an investment solution or to understand its suitability for my clients' current risk profile, basing my assessment on the historic volatility profile alone has some limitations.

How relevant is a 36-month backward view in assessing the suitability of an investment for a 30-year forward-looking decumulation objective?

In the same way, that heart rate can help us understand the terrain behind us, historic volatility can help us with the market fluctuations just experienced.

Therefore if both measures were taken at the precipice of the climb or the base of a market turnaround, it would not present a fair assessment of the upcoming descent.

Term

This is compounded by the effect of term, time horizon or ‘length of the ride’.

It will take some time for these measures to adjust and reflect the current environment. Providers may have reacted, taking risks off the table, adjusting their exposure perhaps inadvertently widening the optimal volatility corridor as they go.

This again makes pacing difficult. Short-term spikes in volatility could inflate views where a plan has already factored in the effect of sequencing and pound cost ravaging and dynamic correlation.

For example, if you simply replay the past, then the Global Financial Crisis would have fallen "off the radar" from 2018 forecasts based on the last 10 years or would have had a smaller weight if a longer period was under consideration.

Either way, the approach would have forecast unrealistically low levels of equity volatility in the lead up to the COVID crisis, which would have been misleading

Consistency

To keep the analogy on track, heart rate is similarly affected by external factors. Fatigue, temperature, hydration, and the volume of espressos you’ve knocked back during pre-ride prep.

In cycling, we look to power as an optimum measurement for training, analysis, and planning. Unlike heart rate which represents your body’s (delayed) response to your input on the pedals, a power meter is a real-time measure of your output, i.e. what your effort is actually amounting to in the real world right now and how much you can exert within a period of time.

Whilst external factors can further negatively influence the reliability and dependability of the data coming from your heart, your efficiency of power generation remains consistent.

Summary

Volatility is also a surrogate measure – akin to heart rate it does not have a guaranteed relationship with the present moment. It cannot capture the effect of future correlations in asset classes such as with Cash and Bonds which are negatively correlated in the short term but positively in the long term.

For mapping to be successful it needs to relate to the term, accounting for evolving asset class correlation as well as the overall position against the efficient frontier. It should be forward-looking and relevant to the clients exact time horizon.

Ultimately, this framework provides volatility with a context to operate within.

What next?