How to effectively communicate pension changes using digital solutions

This article highlights what your business should consider when communicating any changes in pension legislation to consumers using online solutions.

Pension legislation is complex. If consumers fail to understand the pension options available to them, they could well end up making poor or ill-informed decisions which will have a direct impact on their future finances in retirement.

Since April 2015, new pension proposals have allowed those with Defined Contribution (DC) pensions aged 55 or over complete freedom in withdrawing their pension savings in retirement. These changes, amongst others, mean that simply selecting a lifetime annuity at retirement is by no means the only, nor necessarily, the best option. If members of DC schemes do not clearly understand these things, how can they be expected to make well-informed choices?

How can you help consumers?

You can do various things to ensure consumers make the best choices for their finances in retirement.

You will need:

- Clear instructions on the online solution’s functionality

- Simple explanations of financial terminology

- A progressive step-by-step process to educate consumers to a level of understanding whereby they can confidently make an informed decision about their next best steps

- A rewarding online experience for the consumer

- Elements of gamification

- A fully responsive design

- Transparent displays, videos, & graphical imagery of the main options available

- An interface that encourages consumers of all ages to engage in the subject matter

Comprehensive and factually correct information.

How do you get started?

Effective online communication solutions should be:

- Engaging - To gain the consumer’s attention and motivate them into action

- Transparent - Clear and friendly illustrations of future retirement positions should be produced which are easy to understand

- Accurate - Consumers should receive complete and reliable information and explanations.

Engagement

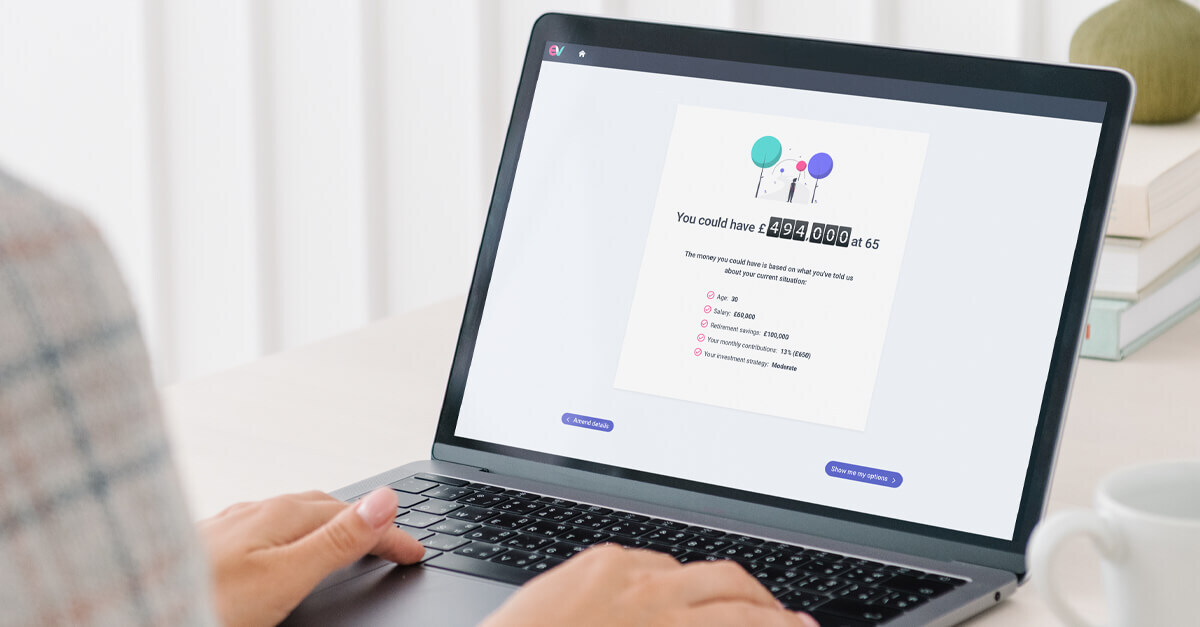

Any online solution that attempts to communicate the potential impact of changes in pension legislation needs to combine complete ease-of-use with high levels of customisation. For example, interactive tools such as calculators, which compare income and expenditure or highlight different retirement solutions, allow pension members to personalise their situation and project a vision of what their retirement will be like. Solutions should also be fully responsive, allowing individuals to explore their retirement options from any chosen device.

Another strategy we use is Gamification, which uses game elements and design, such as point scoring or amassing rewards for completing tasks in non-game environments, including financial planning websites. Aspects of gamification have been proven to result in greater consumer engagement. The idea is to use strategies pioneered in popular games to drive consumer behaviour and engage them with financial websites at the outset to facilitate better financial decisions. By emphasising the element of play, rather than focusing on what’s at stake as financial decisions are considered, online solutions can quell the dread often associated, by many, with the process of dealing with financial matters.

Transparency

Conscious that many consumers find pensions a dull subject, at its heart, any online solution explaining retirement options need to provide an easily digestible, step-by-step process that aims to educate individuals. The ultimate objective of this progressive process is to help consumers fully understand the issues, thus enabling them to make informed and sensible decisions about their future finances.

Consumers will still need to understand the investment risk in their choices. However, imparting such an understanding can be achieved through various graphical tools or simulations that present a range of outcomes. The best online tools depict them, perhaps, with images of what their future lifestyles might look like. Good financial planning packages help consumers see themselves in the future, which dramatically impacts engaging them with long-term savings.

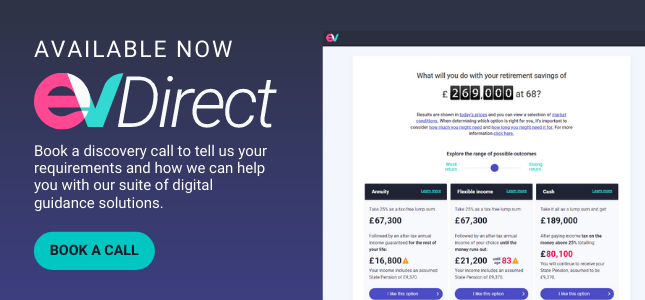

Online tools must use a combination of engaging imagery with user-friendly controls, giving consumers a clear understanding of the retirement options. For example, by effectively explaining each outcome’s assessed chances, by displaying the various retirement options side by side, the consumer can see the impact that different choices would make on their finances in retirement to plan accordingly.

Accuracy

Any communications to pension scheme members should always be fair, clear and not misleading. Communications should accurately reflect any relevant new legislation and provide a range of potential outcomes. This will help individuals tailor their plans in a way that is most appropriate to their requirements.

Forecasts should consider all types of possible scenarios such as significant and sudden rises or drops in the equity markets and are based on crucial information, including age, earnings, savings, contributions, fund choice and target retirement income which the consumer enters. In addition, other existing pensions/savings can also be entered to give a fully holistic view of the individual’s potential retirement income.

Summary

The “guidance guarantee” is designed to give every eligible DC pension member support when deciding on their pension options at retirement. Individuals will, however, undoubtedly want to seek clarification as to what precisely they can do with their pension funds and the ramifications associated with their decisions.

Under these circumstances, effective online solutions, which seek to communicate the pension options available, will become even more critical. Whilst avoiding giving actual financial advice, pension providers and pension schemes need to be up to the task of responding to members’ questions. Not only must online solutions, therefore, be able to answer questions around each outcome’s assessed chances accurately each outcome’s assessed chances, by accurately each, but they should also provide a rewarding and engaging experience for the consumer, allowing them to fully understand the options available whilst enabling them to make the most of their pension freedoms.

So what next?

Start your journey to improve member engagement, increase member pension contributions, and give your business the digital financial guidance solutions to stand out in the marketplace.