At EV, we are determined to do our bit to help improve employees’ understanding of their retirement options. David McDonald explains the hows and whys.

We have responded to the drive by the Pensions and Lifetime Savings Association (PLSA) to – as they say on their website – “cut through the ambiguity that currently surrounds retirement planning.” This trade body is keen to “help savers think in a practical way about the kind of lifestyle they might lead in retirement.”

In synergy with that mission, we’ve created our innovative EVDirect Quick Tools to empower employees to easily look into their retirement prospects based on what they’re putting aside in their pension plan.

Our Quick Tools enable pension and employee benefit providers to give people in the workplace a simple means of better understanding their retirement options. Available at their fingertips, at their desk.

Gentle probing, quick answers

These digital guidance solutions prompt the employee to answer some simple questions to gather a few bits of key information, including:

- What expenses will I need to cover in retirement?

- What lifestyle could I afford when I retire?

- What’s the impact on my retirement if I save more?

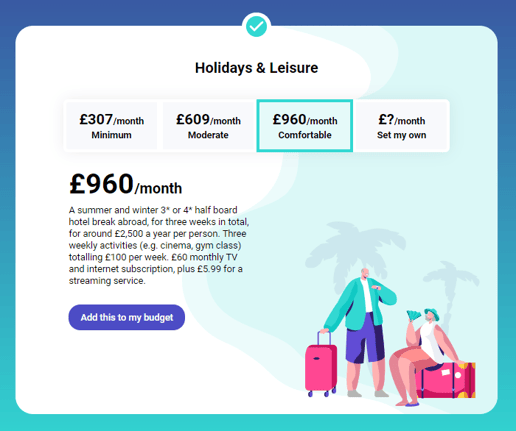

Then, using data from the PSLA’s Retirement Living Standards, the digital wizardry calculates a realistic expectation of the individual’s future financial position – and the budget required to achieve their desired standard of living.

EVDirect Quick Tools Budget Planner

These easy-to-use tools help people understand their financial situation and how today's decisions will impact their potential future lifestyle. It’s about determining how much they should save for a good retirement. Clear outputs are generated, underpinned by EV’s proven modelling expertise, which improves engagement and supports positive decisions while employees save for retirement.

Clearing up confusion

Most people aren’t pensions experts, and expecting them to study and grasp the intricacies involved is unrealistic. Moreover, when they look at their likely total pension pot, it’s hard to understand the lifestyle they’ll be able to afford when they retire. Our Quick Tools cut through the fog and allow the user to delve into what they need to know without inundating them with technical jargon or lots of requests for data. Then there’s the extra consideration of the current cost of living crisis.

“The PLSA recently found that this has added almost 20% to the minimum cost of retirement, which is a huge amount extra for a pensioner to find.”

But with soaring inflation, people have to make difficult decisions over how they spend their money in the short term.

For those considering reducing their pension contributions, because money is tight today, the tools can help them make a more informed decision by clearly showing the impact that changes made right now will have on their future funds. By

improving understanding and engagement with pensions, Quick Tools should also encourage those who need to pause contributions to restart them as soon as their financial position improves.

Supporting better decisions

In the first quarter since launching, our Quick Tools have supported over 2,500 retirement calculations in the workplace. We also offer digital solutions for those closer to retiring, using the individual’s pension data to provide more detailed information about their retirement income options and projected cash flow.

Quick Tools can be embedded directly into their employee-facing portal or platform for our provider customers and branded to match their other tools and materials, offering easy access and a seamless user experience.

All told we are glad to play our part in giving those currently saving for retirement a realistic idea of how much money they will need to invest in their pension so they can fund the lifestyle they want and deserve in later life.

So what next?